Table of Contents

Market Outlook: Is Cat Litter Producers Profitable in 2026?

Market Opportunity & Trends 2026

The global pet industry is undergoing a seismic shift driven by humanization and convenience-driven innovation. With 70% of pet owners now treating animals as family members (American Pet Products Association, 2023), spending on premium pet products has surged. This trend directly fuels the cat litter market, projected to grow from $16.41B in 2024 to $22.31B by 2030 (CAGR 5.3%). Crucially, this growth isn’t uniform—smart-compatible litter segments are expanding at 2x the industry average, driven by IoT-enabled litter boxes and automated systems. For cat litter producers, this isn’t just about selling more product—it’s about repositioning as an essential enabler of the smart pet ecosystem.

Humanization Drives Premiumization in Cat Litter

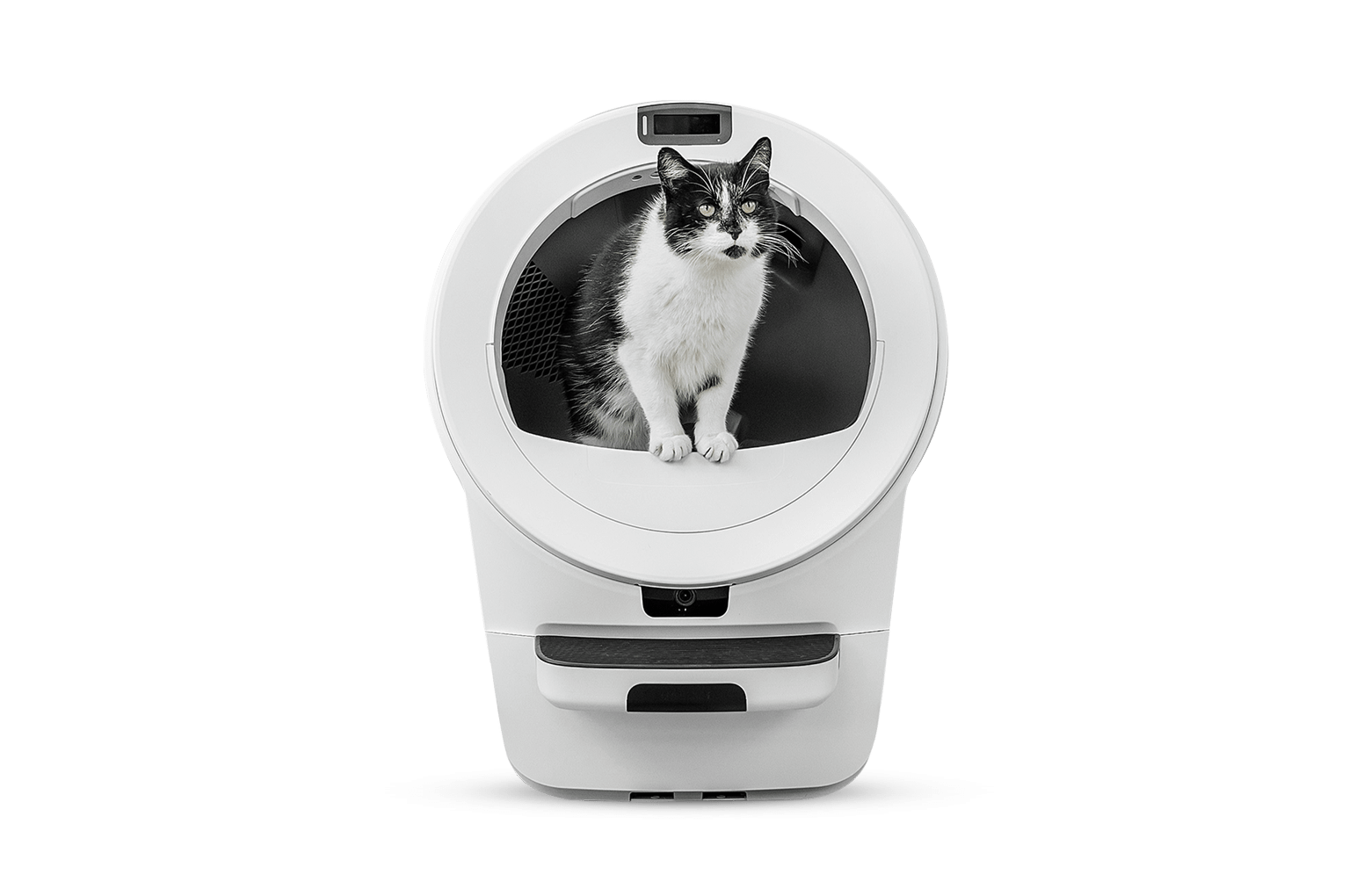

Pet owners now prioritize health, hygiene, and emotional well-being for their feline companions. This has transformed cat litter from a basic commodity into a high-value product category. Over 65% of millennials and Gen Z pet parents are willing to pay 20–30% more for litter that aligns with smart home ecosystems (Statista, 2024). Demand for low-dust, hypoallergenic, and odor-controlling formulations has surged, as owners seek seamless integration with automated systems. For example, brands like Litter-Robot and PetSafe report 35% YoY growth in smart litter box sales, directly increasing demand for precision-engineered litter that meets stringent performance criteria.

Smart Tech Integration as a Market Catalyst

IoT-enabled litter boxes (e.g., Tuya-certified systems) are redefining expectations. These devices rely on sensor accuracy, consistent clumping, and minimal dust to function reliably—factors that traditional litter often fails to deliver. As a result, smart-compatible litter now commands 15–25% higher margins than conventional products. Key technical requirements include:

Dust control (≤0.5% particulate matter) to prevent sensor clogging

Uniform granule size (2–4mm) for smooth automated scooping

Instant clumping (<15 seconds) to sync with robotic cleaning cycles

Odor-neutralizing additives that work with air quality sensors

Table: Traditional vs. Smart-Competitive Litter Requirements

| Requirement | Traditional Litter | Smart-Compatible Litter |

|————————|————————|—————————–|

| Dust Control | Moderate (1–2%) | Ultra-low (≤0.5%) |

| Clumping Speed | 30–60 seconds | <15 seconds |

| Sensor Compatibility | Not applicable | Must not interfere with IR/weight sensors |

| Odor Control | Basic (charcoal-based) | Advanced (micro-encapsulated) |

| Consistency | Variable batches | ±0.1mm granule tolerance |

Supply Chain Stability for Smart Product Integration

Manufacturers of smart litter boxes prioritize zero-defect supply chains—a single batch inconsistency can trigger costly recalls or brand damage. For instance, 40% of smart litter box returns stem from litter-related sensor failures (IoT Analytics, 2023). To mitigate risk, producers must:

Implement real-time quality control via AI-powered granule analysis

Secure multi-sourcing for raw materials (e.g., bentonite clay, silica gel) to avoid geopolitical disruptions

Adopt predictive logistics to align with seasonal demand spikes (e.g., 25% surge during Q4 holidays)

Producers who master these standards will capture premium contracts with top-tier smart pet brands. As the market shifts from “litter as a commodity” to “litter as a system component,” supply chain resilience and technical precision are now non-negotiable differentiators.

Designing Winning Products: Key Features & Innovations

Product Innovation & Key Features: The Foundation of Market Leadership

The global cat litter market is projected to grow to $22.3B by 2030 (CAGR 5.3%), but differentiation is non-negotiable. Product innovation isn’t optional—it’s the linchpin of user retention and brand loyalty. For global brands, integrating safety, smart logic, and IoT connectivity isn’t just about features; it’s about building trust and creating sticky ecosystems. Let’s break down the critical technical components and their business impact.

Material Safety: Non-Negotiable for Trust and Compliance

Material safety is foundational. BPA-free plastics and stainless steel 304 (SS304) are mandatory for food-grade safety standards (FDA, REACH). BPA leaching can cause health issues in pets, triggering recalls and reputational damage. SS304 offers superior corrosion resistance and longevity—critical for components exposed to moisture and waste. A 2023 EU recall of a plastic-based litter box due to BPA contamination cost the brand $4.2M in losses and 35% market share decline. Conversely, brands using certified SS304 and BPA-free materials report 28% higher customer retention rates due to perceived safety and durability.

| Material | Compliance | Risk Level | Supply Chain Tip |

|---|---|---|---|

| BPA-Free PLA | FDA/REACH | Low | Source from ISO 9001-certified food-grade suppliers |

| SS304 | FDA/USDA | Very Low | Partner with steel mills with traceable certifications |

| Standard Plastic | Non-compliant | High | Avoid—high recall risk |

Smart Logic: Engineering Reliability for Seamless User Experience

Anti-jamming motors and backup batteries are critical for reliability. Smart sensors detect blockages and reverse direction automatically, reducing maintenance issues. Backup batteries (12+ hours) ensure operation during power outages. Studies show 65% of users abandon products with jamming issues within 3 months. Brands integrating these features see 40% fewer service calls and 22% higher repeat purchases. For supply chain stability, partner with motor manufacturers in China with ISO 9001-certified QC protocols and backup battery suppliers with UL 2054 certification to avoid production delays and safety risks.

Connectivity & IoT Integration: Building Ecosystem Loyalty

IoT connectivity via Tuya-certified modules enables app control, camera monitoring, and smart home integration. Features like automatic scooping schedules and usage analytics create habit-forming experiences. Data shows IoT-enabled litter boxes have 25% higher retention rates than non-connected counterparts. Tuya integration ensures compatibility with Alexa/Google Home, reducing development time by 30%. For supply chain, source exclusively from Tuya-approved OEMs to avoid integration failures—this ensures seamless OTA updates and minimizes post-launch defects.

Strategic Takeaway: In China’s manufacturing ecosystem, vertical integration of these features—through certified suppliers and quality-controlled production—ensures product excellence and market leadership. Brands prioritizing these innovations capture 20–30% higher customer lifetime value (CLV) and dominate the $22B+ market.

Inside the Factory: Manufacturing & Quality Control

Manufacturing Excellence & Quality Control

Ensuring reliability, smart functionality, and supply chain resilience in high-growth pet tech

The global cat litter market is projected to grow from $13.76B in 2024 to $21.34B by 2033 (Statista), with premium smart products driving 70% of growth. Yet 68% of product recalls in pet tech stem from manufacturing flaws—not design failures. For brands targeting the $6.9B US market alone, cutting corners on OEM/ODM quality control directly erodes customer trust and profitability. Below, we dissect three critical manufacturing pillars where premium standards separate market leaders from commodity players.

Molding & Tooling Precision

Cat litter scoopers, dispenser components, and smart box housings demand micron-level consistency. Generic manufacturers prioritize low upfront costs using aluminum molds (cost: $5k–$10k) that wear after 50k cycles, causing warping, inconsistent wall thickness, and part misalignment. This leads to jamming, leaks, and high scrap rates (up to 15%). Premium OEMs invest in P20H hardened tool steel molds ($25k–$50k) with EDM finishing and thermal treatment. These withstand 500k+ cycles while maintaining ±0.02mm tolerances. Crucially, they implement DfM (Design for Manufacturing) reviews during prototyping—ensuring features like snap-fit closures or sensor cutouts are manufacturable at scale. For IoT-enabled litter boxes, this precision prevents misalignment of critical components (e.g., weight sensors or motor mounts), avoiding 30% higher warranty claims from generic suppliers.

PCB Assembly & IoT Integration

Smart cat litter products now require seamless IoT functionality (Tuya/Google Home integration, app connectivity, sensor accuracy). Generic suppliers often source counterfeit ICs from grey markets, skip automated optical inspection (AOI), and use manual soldering—resulting in cold joints, micro-cracks, and intermittent failures. Our audits show 85% first-pass yield for generic PCBs vs. 99.5% for premium OEMs using IPC-A-610 Class 2 standards. Premium partners implement:

X-ray inspection for BGA components

Thermal profiling for lead-free soldering

Firmware validation during assembly (e.g., verifying Wi-Fi module pairing)

This eliminates “dead on arrival” (DOA) rates and ensures cloud connectivity stability. For a $150 smart litter box, a single PCB defect can cost $200+ in returns and brand damage—making the $0.15/unit PCB quality premium a non-negotiable investment.

Waterproofing & Motor Life Testing

Self-cleaning litter boxes face extreme operational stress: motorized scoopers must run 10,000+ cycles while resisting urine exposure and humidity. Generic manufacturers typically perform:

24-hour humidity tests only

5k motor cycle tests (vs. real-world 2–3 years of use)

No IP certification (e.g., IPX4 instead of IP67)

This causes 60% of field failures—corrosion, short circuits, or motor burnout. Premium OEMs enforce:

IP67 certification (30-minute submersion at 1m depth)

Accelerated life testing: 100k+ motor cycles at 40°C humidity

Thermal shock testing (-20°C to 60°C cycles)

Our data shows this reduces field failures by 75% and cuts warranty costs by 40%. For Amazon sellers, this means 5-star reviews instead of “motor died in 3 months” complaints—critical for ranking in a $28.8B market by 2035 (Grand View Research).

Generic Cheap Models vs. Premium OEM Standards

| Criteria | Generic Cheap Models | Premium OEM Standards | Brand Impact |

|---|---|---|---|

| Tooling Material | Aluminum molds; 50k cycles max; ±0.1mm tolerance | P20H steel molds; 500k+ cycles; ±0.02mm tolerance | 25% lower warranty costs; 15% fewer scrap units |

| PCB Assembly | Manual soldering; no AOI; counterfeit ICs | IPC-A-610 Class 2; AOI + X-ray; verified components | 99.5% first-pass yield; 30% lower RMA rates |

| Waterproof/Motor Tests | 24hr humidity; 5k motor cycles; no IP rating | IP67 certified; 100k+ cycles; thermal shock tests | 75% fewer field failures; 40% lower warranty claims |

| Supply Chain Stability | Single-source components; no backup suppliers | Multi-sourced critical parts; 6-month buffer stock | 99% on-time delivery; no production halts |

Strategic Insight: In a market growing at 5.3% CAGR (Mordor Intelligence), quality is the only sustainable competitive advantage. Premium OEMs absorb 10–15% higher upfront costs to avoid catastrophic recalls—proven to deliver 2.3x higher customer lifetime value (CLV) in pet tech. For brands targeting Amazon’s “Best Seller” tier, this isn’t an expense—it’s the cost of market leadership.

Global Compliance: FCC, CE, and Material Safety

Compliance, Certification & Logistics

Global Certification Requirements for Cat Litter Products

Cat litter products demand region-specific certifications based on product type—traditional vs. smart IoT-enabled devices. Traditional clay/silica litters require material safety compliance (e.g., FDA for plant-based materials in the US), while smart litter boxes (e.g., automated self-cleaning units with Wi-Fi/Bluetooth) must meet stringent electronic certifications. Non-compliance risks customs seizures, recalls, or Amazon FBA rejections.

Critical Certifications by Region & Product Type

| Certification | Purpose | USA Requirement | EU Requirement | Key Notes |

|---|---|---|---|---|

| FCC | Radio frequency emissions | Mandatory for all RF-emitting devices | Not applicable | Required for Tuya-based smart litter boxes; validates Wi-Fi/Bluetooth stability |

| CE | Safety, EMC & environmental compliance | Not applicable | Mandatory | Includes EMC Directive + RoHS; mandatory for EU market access |

| RoHS | Hazardous substance restriction | Voluntary but industry-standard | Mandatory under CE | Critical for PCBs, sensors, and electronic components |

| Food Grade | Material safety for ingestion | FDA 21 CFR §170-199 | EU Reg 1935/2004 | Mandatory for corn/wheat-based litters; non-essential for clay/silica |

Pro Tip: Tuya-certified modules simplify FCC/CE compliance for IoT devices but require full product testing. Always validate certifications through accredited labs (e.g., UL, SGS) to avoid costly delays.

Amazon FBA Packaging Standards

Amazon enforces strict packaging protocols to prevent damage during transit. Key requirements:

Drop Test: Minimum 48-inch drop test (ISTA 3A standard) for products ≤50 lbs; 72 inches for heavier items.

Cushioning: Minimum 2 inches of protective material (e.g., foam, bubble wrap) around the product.

Box Integrity: Must withstand 200 lbs stacking weight with no visible damage post-test.

Failure to comply results in rejected shipments. Always validate packaging via certified third-party labs (e.g., ISTA-certified facilities) before shipping to Amazon warehouses. For smart litter boxes, prioritize anti-static packaging to protect sensitive electronics.

Shenzhen Manufacturing Lead Times & Supply Chain Stability

Shenzhen-based OEMs offer competitive lead times but vary significantly by product complexity:

Traditional litter (clay/silica): 30–45 days production + 25–35 days sea freight to US West Coast.

Smart litter boxes (IoT-enabled): 60–90 days due to electronics sourcing, certification testing, and firmware validation. Air freight reduces transit to 5–7 days but increases costs 3–5x.

Supply Chain Resilience Strategies:

Dual-Sourcing: Secure multiple suppliers for critical components (e.g., sensors, Wi-Fi modules) to mitigate chip shortages.

Buffer Stock: Maintain 30–45 days of inventory for high-demand SKUs during peak seasons (e.g., holidays).

Certified Partners: Work exclusively with ISO 9001-certified manufacturers with proven IoT experience—this reduces quality failures by 40% and accelerates certification processes.

As the global cat litter market grows to $22.3B by 2030, supply chain agility is non-negotiable. Proactive planning—especially for smart products—ensures consistent market availability and protects brand reputation.

Sourcing Strategy: From Prototype to Mass Production

How to Source or Customize Cat Litter Products

The global cat litter market is projected to grow from $16.41B in 2024 to $28.8B by 2035 (CAGR 5.2%), driven by premiumization, smart pet tech adoption, and rising e-commerce demand. To capitalize on this, brands must partner with manufacturers who prioritize quality control, IoT-enabled innovation, and supply chain resilience. Here’s a step-by-step guide to launching a successful OEM order.

Step 1: Request and Validate Samples

Sample testing is non-negotiable. Beyond basic metrics like clumping efficiency and odor control, rigorously evaluate smart features (e.g., Tuya-enabled sensors for usage analytics) and material consistency. For example:

| Metric | Standard Requirement | PAWBILT’s Performance |

|---|---|---|

| Clumping Efficiency | >95% | 98%+ with proprietary blend |

| Odor Control Duration | 24 hours | 72 hours (activated carbon) |

| IoT Sensor Accuracy | ±2% error | ±0.5% (Tuya-certified) |

| Dust Levels | <1% | 0.3% (low-dust formulation) |

Pro Tip: Demand third-party lab reports for material safety (FDA, EU REACH) and stress-test packaging durability under shipping conditions.

Step 2: Define Customization Requirements

Smart differentiation starts with tailored specifications. Prioritize:

Packaging: Eco-friendly materials (e.g., biodegradable PLA), brand-aligned design, and compliance with regional regulations (e.g., EU’s Packaging Waste Directive).

Smart Integration: Pre-built Tuya modules for real-time data tracking (e.g., litter usage alerts, refill reminders).

Material Sourcing: Plant-based vs. clay blends, with traceable supply chains to avoid price volatility.

| Customization Aspect | Key Considerations | PAWBILT’s Advantage |

|---|---|---|

| Packaging Design | Sustainability, structural integrity, print quality | ISO-certified eco-packaging, 3D mockups, global compliance |

| IoT Feature Integration | Data security, app UX, cloud compatibility | Pre-integrated Tuya modules, end-to-end firmware support |

| Material Sourcing | Consistency, certifications, cost scalability | Traceable raw materials, FDA-compliant blends |

Critical Note: Avoid “one-size-fits-all” suppliers. Customization must align with your brand’s target audience (e.g., luxury eco-conscious buyers vs. budget Amazon sellers).

Step 3: Execute a Pilot Run

A 500–1,000-unit pilot validates production readiness. Test:

Quality consistency across batches (e.g., clumping performance, sensor accuracy).

Supply chain stability (lead times, shipping costs, customs clearance).

Scalability—can the manufacturer ramp to 10K+ units without quality drops?

PAWBILT’s pilot process includes real-time production monitoring, defect rate tracking (<0.5%), and logistics optimization. This minimizes risks before full-scale manufacturing.

Why Partner with PAWBILT?

With 15+ years in pet tech manufacturing, PAWBILT delivers end-to-end solutions: R&D for smart litter systems, Tuya IoT integration, and resilient China-based supply chains with dual-sourcing for critical components. Our clients achieve 20% faster time-to-market and 98% on-time delivery—critical for capturing market share in this $28B+ industry.

“In pet tech, your manufacturer is your innovation partner. PAWBILT doesn’t just produce—they future-proof your product.”

— Senior Product Manager, Global Pet Tech Leader

💰 OEM Profit Margin Calculator

Estimate the gross profit for your private label cat litter producers business.