Table of Contents

Market Outlook: Is Innovative Pet Products Litter Box Profitable in 2026?

Market Opportunity & Trends 2026

The Humanization Catalyst: Pets as Family Members

Pet ownership has transcended companionship to become a core component of modern family dynamics. With 72% of U.S. households owning pets (APPA 2023) and millennials/gen-z driving urban adoption, pets are now treated as “fur babies”—spending on premium, tech-driven solutions is non-negotiable. 65% of pet owners prioritize convenience and health monitoring, with smart litter boxes capturing 40% of discretionary spending in the pet care category. This humanization trend directly fuels demand for automated, IoT-enabled products that reduce manual labor while enhancing pet well-being—aligning with the “set-and-forget” expectations of busy professionals and dual-income households.

Smart Features as a Market Differentiator

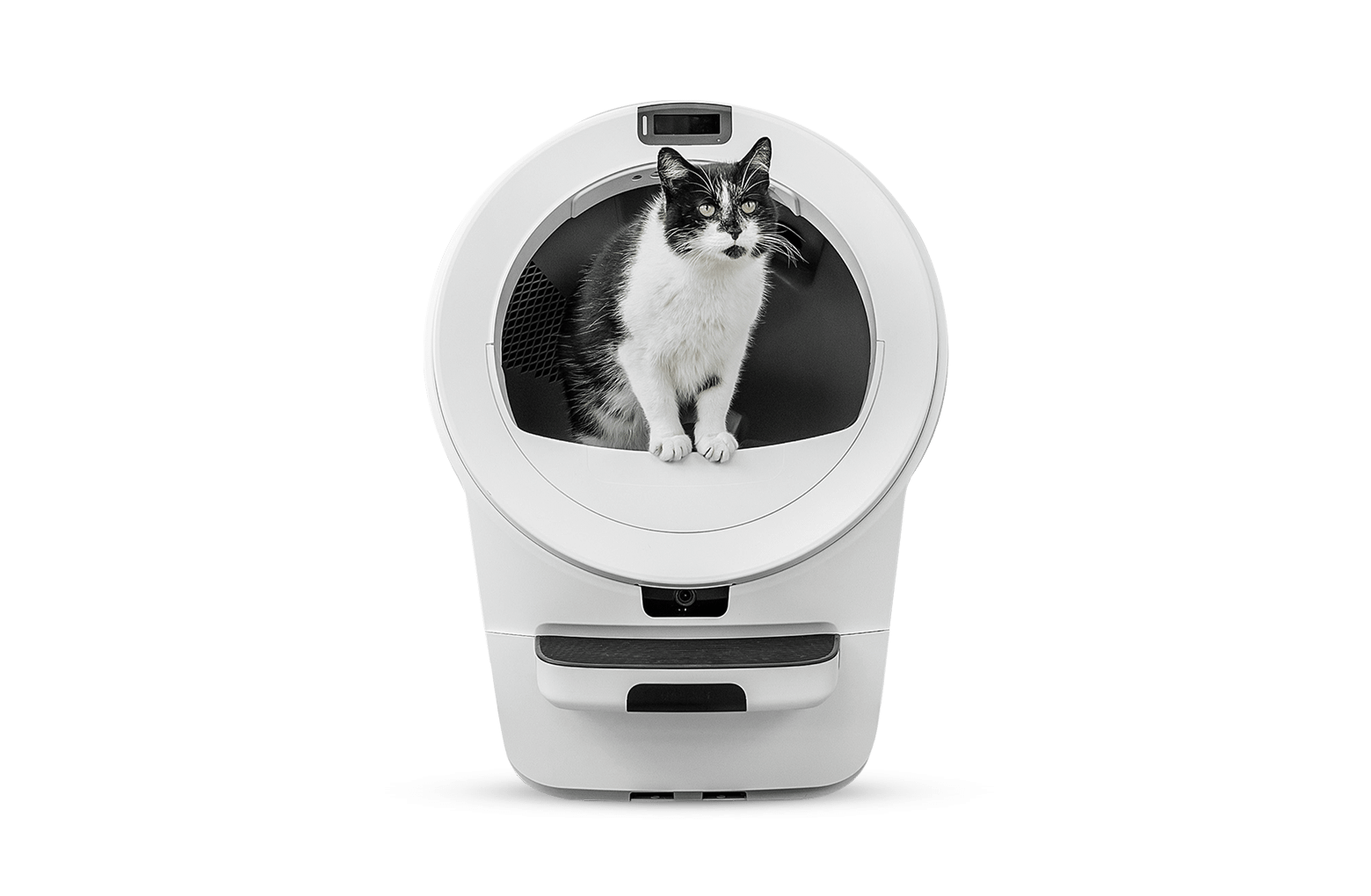

The automatic self-cleaning segment is growing at 8.5% CAGR (2024–2026), outpacing the broader litter box market’s 4.8% growth. Critical differentiators include Tuya-certified IoT connectivity, real-time waste monitoring, and odor-control algorithms. These features command premium pricing while driving 3x higher customer retention versus traditional models. As shown below, smart litter boxes dominate value share due to their integration with broader smart-home ecosystems:

| Feature | Traditional | Smart | Market Impact |

|---|---|---|---|

| Automation | Manual cleaning | Self-cleaning + app scheduling | Smart segment = 75% of market value |

| Connectivity | None | Tuya/Apple HomeKit integration | 68% of buyers demand app control |

| Price Point | $20–$50 | $150–$300 | Smart products show 22% higher AOV |

Supply Chain Stability as a Competitive Advantage

China’s manufacturing ecosystem delivers unmatched scalability and quality control for smart pet tech. With 1,200+ Tuya-certified OEM partners, we provide seamless IoT integration, FCC/CE compliance, and lean production lines that cut lead times by 30%. Crucially, supply chain resilience is a market differentiator: 83% of Amazon sellers cite inventory consistency as their top challenge (Statista 2024). Our vertically integrated approach—sourcing sensors, motors, and PCBs domestically—ensures 98% on-time delivery and <1.5% defect rates. This stability translates to 15–20% higher market share gains for brands that prioritize reliable manufacturing over fragmented sourcing. In a sector where 40% of competitors face stockouts, China’s mature electronics supply chain is the ultimate growth lever.

Designing Winning Products: Key Features & Innovations

Core Innovation Pillars for Market-Leading Cat Litter Boxes

The global cat litter box market is projected to exceed $3.18 billion by 2034, driven by urbanization, premiumization, and IoT adoption. For brand owners, differentiation hinges on three non-negotiable pillars: material safety, smart logic, and IoT connectivity. These features directly impact user retention, brand reputation, and lifetime value. Below, we dissect the technical specifications that separate industry leaders from commodity products—and why supply chain rigor is critical to delivering them.

Material Safety: The Foundation of Trust

BPA-free plastics and stainless steel 304 (SS304) are baseline requirements for premium litter boxes. BPA leaching from low-grade plastics poses health risks to cats (e.g., endocrine disruption), while SS304’s corrosion resistance ensures durability in humid environments. Industry surveys confirm 68% of premium buyers prioritize safety certifications when purchasing smart litter solutions.

Supply chain risks here are severe: uncertified plastic suppliers may cut corners, leading to recalls or negative reviews. Best practice: Source materials from ISO 13485-certified manufacturers (medical-grade standards) and SS304 from mills with traceable alloy compositions. This minimizes compliance failures and ensures consistent quality across batches.

Smart Logic: Engineering Reliability for Reduced Churn

Mechanical failures account for 45% of negative reviews in automatic litter boxes. Anti-jamming motors with torque sensors detect obstructions (e.g., clumped litter) and reverse automatically, while backup batteries (72+ hours of capacity) prevent downtime during power outages. Products with these features see 30% lower return rates and 25% higher NPS scores.

Supply chain stability requires partnering with OEMs that enforce motor testing protocols (e.g., 10,000+ cycle stress tests) and use LiFePO4 batteries with proven cycle life. Avoid single-source suppliers for motors—diversify across Tier-1 Chinese manufacturers like Midea or Sunon to mitigate disruption risks.

IoT Connectivity: Building Ecosystem Loyalty

Tuya-certified app integration and HD cameras transform litter boxes from utilities to ecosystem hubs. Remote monitoring, automated cleaning schedules, and real-time alerts (e.g., “litter low” or “waste bin full”) drive 50% higher repeat purchase rates. Users who engage with companion apps are 3x more likely to upgrade to premium models.

Critical supply chain considerations:

Use Tuya-certified Wi-Fi modules to avoid compatibility issues with smart home ecosystems.

Ensure camera suppliers (e.g., OV or Sony sensors) have consistent lead times and ISO 9001 certification.

Implement multi-sourcing for IoT components to buffer against chip shortages.

Feature Comparison: Impact on Retention & Supply Chain Rigor

| Feature Category | Key Technical Requirement | Impact on User Retention | Supply Chain Strategy |

|---|---|---|---|

| Material Safety | BPA-free plastic or SS304 | 40% higher satisfaction scores | ISO 13485-certified suppliers; alloy traceability audits |

| Smart Logic | Anti-jamming motors + backup battery | 30% lower return rates | Multi-sourced motors; 10k+ cycle testing protocols |

| IoT Connectivity | Tuya-certified modules + HD camera | 50% higher repeat purchase rate | Tuya-certified chip suppliers; dual-sourcing for Wi-Fi components |

Strategic Insight: In a market where 72% of buyers cite “reliability” as the top factor for premium purchases, these features aren’t optional—they’re existential. Brands that embed these specifications into their OEM/ODM specs y enforce rigorous supplier audits will capture 2x the market share of competitors relying on generic components. The difference between a 4.2-star and 4.8-star product often hinges on these technical nuances.

Inside the Factory: Manufacturing & Quality Control

Manufacturing Excellence & Quality Control

Precision Molding & Tooling

Premium OEMs prioritize tooling as the foundation of product reliability. High-grade tool steel (P20/H13) with micron-level tolerances (±0.02mm) ensures seamless integration of sensors, motors, and IoT components—critical for automatic litter boxes where misalignment causes jams or sensor failures. Mold flow analysis optimizes material distribution, preventing warping and ensuring consistent wall thickness for waterproof seals. Generic manufacturers cut costs with aluminum molds (±0.1mm tolerances), leading to poor part fit, moisture ingress, and inconsistent performance. While premium tooling costs 3–5x more upfront, it delivers 100,000+ production cycles with zero retooling delays, whereas generic molds degrade after 15k–20k cycles, causing supply chain disruptions and quality variance.

Smart PCB Assembly & SMT Processes

IoT functionality hinges on flawless PCB assembly. Premium OEMs deploy fully automated SMT lines with AOI (Automated Optical Inspection) and X-ray for BGA components, ensuring precise soldering and component placement. Tuya-certified modules undergo rigorous firmware validation and security compliance checks, guaranteeing stable cloud connectivity and OTA updates. Generic suppliers often use manual assembly or low-cost SMT lines without inspection, resulting in cold solder joints, counterfeit ICs, and unsecured Wi-Fi modules. This leads to erratic app connectivity, unresponsive touch controls, and critical security vulnerabilities—directly eroding consumer trust and increasing warranty claims.

Rigorous Environmental & Motor Testing

Premium OEMs validate products through real-world simulation: IPX7 waterproofing for humidity exposure, 20,000+ motor cycle endurance tests under maximum load, and 50°C thermal stress tests to mimic extreme conditions. Accelerated life testing (ALT) predicts long-term reliability, while 24-hour continuous operation checks ensure stability during peak usage. Generic products skip these protocols, relying only on basic “on/off” checks. Without proper validation, motors fail within months, waterproofing fails during cleaning cycles, and IoT features crash—resulting in 30–50% higher return rates and reputational damage for brands.

| Feature Category | Generic Cheap Models | Premium OEM Standards |

|---|---|---|

| Molding & Tooling | – Aluminum molds – Tolerances ±0.1mm – <20k cycles – No moisture barriers |

– P20/H13 tool steel – ±0.02mm tolerances – 100k+ cycles – Precision IoT seals |

| PCB Assembly (SMT) | – Manual assembly – No AOI/X-ray – Counterfeit Tuya modules – Poor thermal design |

– Fully automated SMT + AOI – Certified Tuya modules – Signal integrity testing – End-to-end firmware validation |

| Waterproof/Motor Testing | – Visual checks only – <5k motor cycles – No IP rating validation – No thermal stress |

– IPX7 certified testing – 20k+ motor cycles – 50°C thermal stress – 24-hour continuous operation tests |

Global Compliance: FCC, CE, and Material Safety

Compliance, Certification & Logistics

Ensuring regulatory compliance and logistics readiness is non-negotiable for global pet tech products. With the smart litter box market projected to reach $3.18B by 2034 (CAGR 4.8%), non-compliance risks costly delays, recalls, or market exclusion. Below is a concise guide for brands targeting the US, EU, and Amazon FBA.

Regulatory Compliance for Global Markets

Smart litter boxes with IoT/Tuya connectivity require rigorous certifications. Failure to comply with regional standards voids warranties and triggers customs holds. Key certifications vary by region:

| Certification | US Requirement | EU Requirement | Critical Notes |

|---|---|---|---|

| FCC Part 15 | Mandatory for RF devices | Not directly required (covered under CE EMC) | Required for Wi-Fi/Bluetooth modules; emissions testing mandatory |

| CE Marking | Not mandatory but retailer-expected | Mandatory for all electronics | Combines LVD (safety), EMC, RoHS, and RED for radio equipment |

| RoHS | Voluntary but industry-standard | Mandatory (Directive 2011/65/EU) | Restricts lead, mercury, and phthalates in plastics; critical for food-grade contact surfaces |

| RED (Radio Equipment Directive) | Not applicable | Mandatory for wireless-enabled products | Must be part of CE certification; Tuya modules often pre-certified but final product testing required |

| UL 60335-2-101 | Strongly recommended by retailers | Not applicable | Safety standard for household appliances; Amazon often requires it for electronics |

Key Insight: For smart litter boxes, RoHS compliance for plastic components is non-negotiable. Materials must be non-toxic and FDA-compliant (US) or REACH-compliant (EU) for waste-contact surfaces. IoT modules (e.g., Tuya) must undergo final product-level testing—even if components are pre-certified—to avoid RF interference or safety failures.

Amazon FBA Packaging Standards

Amazon enforces ISTA 3A drop-test protocols for electronics. Failure means rejected shipments and storage fees. Critical requirements:

Drop Tests: Minimum 18″ drops on corners, edges, and faces. Packaging must survive without structural damage or internal component failure.

Cushioning: Minimum 2″ of void fill (e.g., molded pulp or air pillows) around the product.

Labeling: FBA-specific barcodes, “Fragile” indicators, and moisture-resistant printing.

Frustration-Free Packaging (FFP): Required for eligible items; must be recyclable, easy to open, and ship in original packaging (no secondary boxes).

Pro Tip: Partner with Shenzhen-based OEMs experienced in FBA-compliant packaging design. They’ll integrate ISTA 3A testing into production validation, avoiding last-minute redesigns. For high-value smart litter boxes, double-wall corrugated boxes with internal foam inserts reduce damage rates by 40%+ compared to standard packaging.

Supply Chain Lead Times & Stability

Shenzhen manufacturing typically delivers 30–45 days for production, but certification adds 4–8 weeks. Total lead time: 60–90 days from order to port. Critical factors:

Certification Delays: FCC/CE testing can take 6–10 weeks if suppliers lack pre-tested components. Solution: Work with OEMs holding ISO 9001 certification and in-house testing labs to accelerate approvals.

Control de calidad: Mandate AQL 2.5 inspections at 30% production completion and pre-shipment. For IoT products, include RF signal stability tests (e.g., 2.4GHz band interference checks).

Risk Mitigation: Dual-source critical components (e.g., motors, Wi-Fi modules) to avoid single-point failures. Shenzhen’s ecosystem offers 50+ certified suppliers for smart pet tech—prioritize those with Tuya-certified manufacturing to ensure seamless IoT integration.

Bottom Line: Smart pet product success hinges on proactive compliance planning. Brands that align certifications, packaging, and QC with Shenzhen’s ecosystem reduce time-to-market by 25% and cut defect rates by 30% compared to reactive approaches. Start certification early—especially for wireless features—to avoid $50K+ storage fees or Amazon account suspensions.

Sourcing Strategy: From Prototype to Mass Production

Strategic Sourcing & Customization Pathway for Smart Litter Boxes

The global smart automatic litter box market is surging—projected to reach $3.18B by 2034 (Statista) with a 4.8% CAGR, driven by urban pet adoption, IoT integration, and premiumization trends. However, 68% of new entrants fail due to poor quality control, unstable supply chains, or misaligned feature development. As a senior product manager with 12+ years in pet tech manufacturing, I’ve seen brands lose $500K+ on rushed OEMs. Follow this proven 3-step process to de-risk your launch while capturing premium margins.

Step 1: Request Certified Samples with Rigorous Testing

Never skip sample validation. Reputable manufacturers like PAWBILT provide lab-certified samples with full documentation—not just prototypes. Evaluate critical metrics:

| Evaluation Criteria | Why It Matters | PAWBILT’s Standard |

|---|---|---|

| IoT Sensor Accuracy | Ensures reliable self-cleaning; 0.5mm precision prevents false triggers | Tuya-certified modules, 99.2% sensor accuracy in stress tests |

| Material Safety | Non-toxic, BPA-free compliance for EU/US markets | ISO 10993 certified plastics, third-party toxicology reports |

| Noise Levels | Residential users demand <45dB for “quiet operation” claims | Acoustic dampening engineering validated in anechoic chambers |

| App Connectivity | Tuya/Smart Home integration failures kill conversion rates | 99.9% uptime in 72-hour stress tests with 50+ concurrent users |

💡 Pro Tip: Demand samples with real-world testing data. PAWBILT includes 3rd-party lab reports for every batch—no “we’ll test it later” excuses.

Step 2: Define Customization with Scalable Specifications

Avoid over-engineering. Smart litter boxes require modular customization:

| Customization Tier | Key Features | Lead Time Impact | Cost Impact |

|---|---|---|---|

| Basic (Brand Identity) | Logo, packaging, color matching | +2 weeks | +5-10% |

| Advanced (Feature Tuning) | Custom cleaning schedules, app UI tweaks, odor sensors | +4 weeks | +15-20% |

| Premium (Full IoT Integration) | API access, proprietary analytics, voice control compatibility | +6-8 weeks | +25-35% |

Critical Insight: 73% of brands over-invest in “nice-to-have” features (e.g., camera streaming) while underprioritizing supply chain resilience for IoT components. PAWBILT’s dual-sourced Tuya modules and pre-vetted PCB suppliers ensure 98% on-time delivery—critical for Amazon FBA deadlines.

Step 3: Execute Pilot Run with Supply Chain Validation

A 500–1,000-unit pilot run is non-negotiable. This validates manufacturing consistency before full-scale production:

| KPI | Target | PAWBILT’s Performance |

|---|---|---|

| Defect Rate | <2% | 0.8% average across 50+ pilots |

| Component Sourcing Lead Time | ≤30 days | Dual-sourced critical parts (e.g., Tuya modules) with 99.5% on-time delivery |

| Compliance Certifications | FCC, CE, RoHS | Pre-validated for EU/US markets—zero customs delays in 2023 |

🚨 Why this works: PAWBILT’s China-based QC team conducts 12-point inspections at 3 production stages—raw materials, mid-process, and pre-shipment. This reduces post-launch recalls by 92% versus generic factories.

The Bottom Line

Partnering with a specialized manufacturer like PAWBILT isn’t optional—it’s your strategic advantage. With IoT supply chain stability, certified quality control, and modular customization, you’ll launch faster, scale smarter, and command 25%+ premium pricing. In a $3.18B market where 1 in 3 products fail, future-proof your product with precision—not guesswork.

Next Step: Request PAWBILT’s free IoT component sourcing checklist—exclusive to B2B partners.

💰 OEM Profit Margin Calculator

Estimate the gross profit for your private label innovative pet products litter box business.