Table of Contents

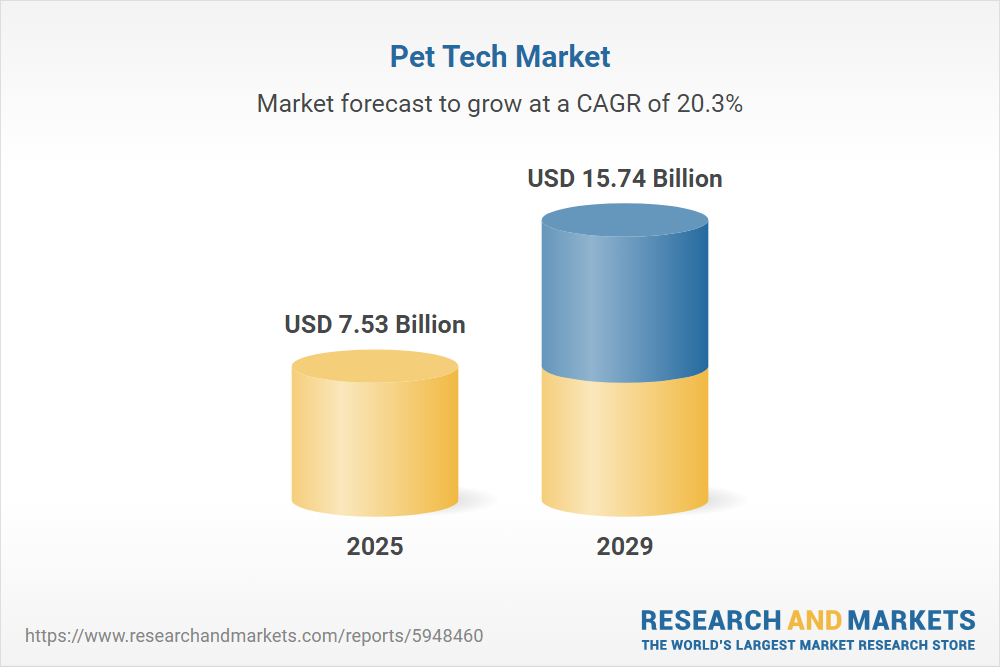

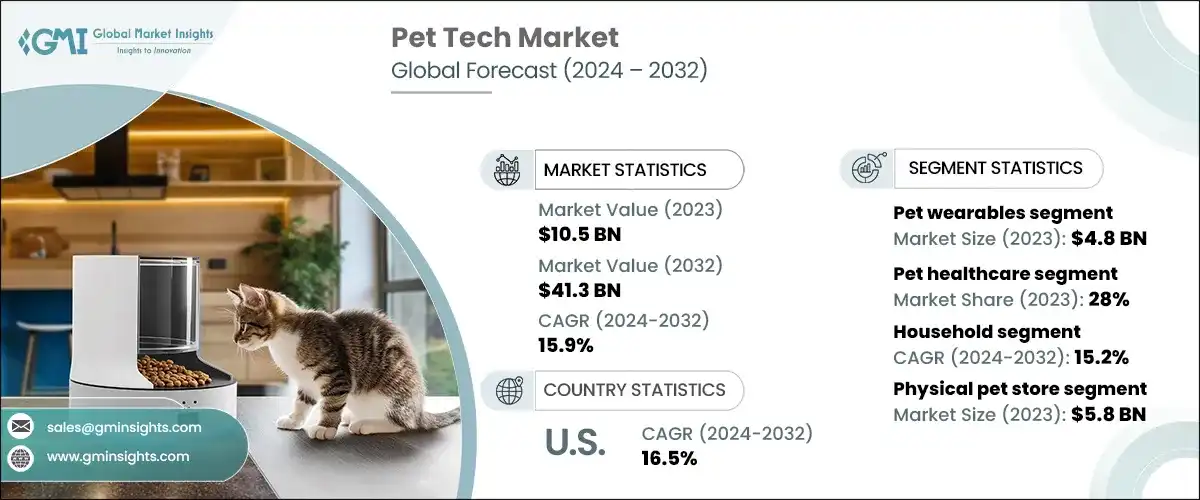

Market Outlook: Is Pet Tech Market Analysis 2025 Profitable in 2025?

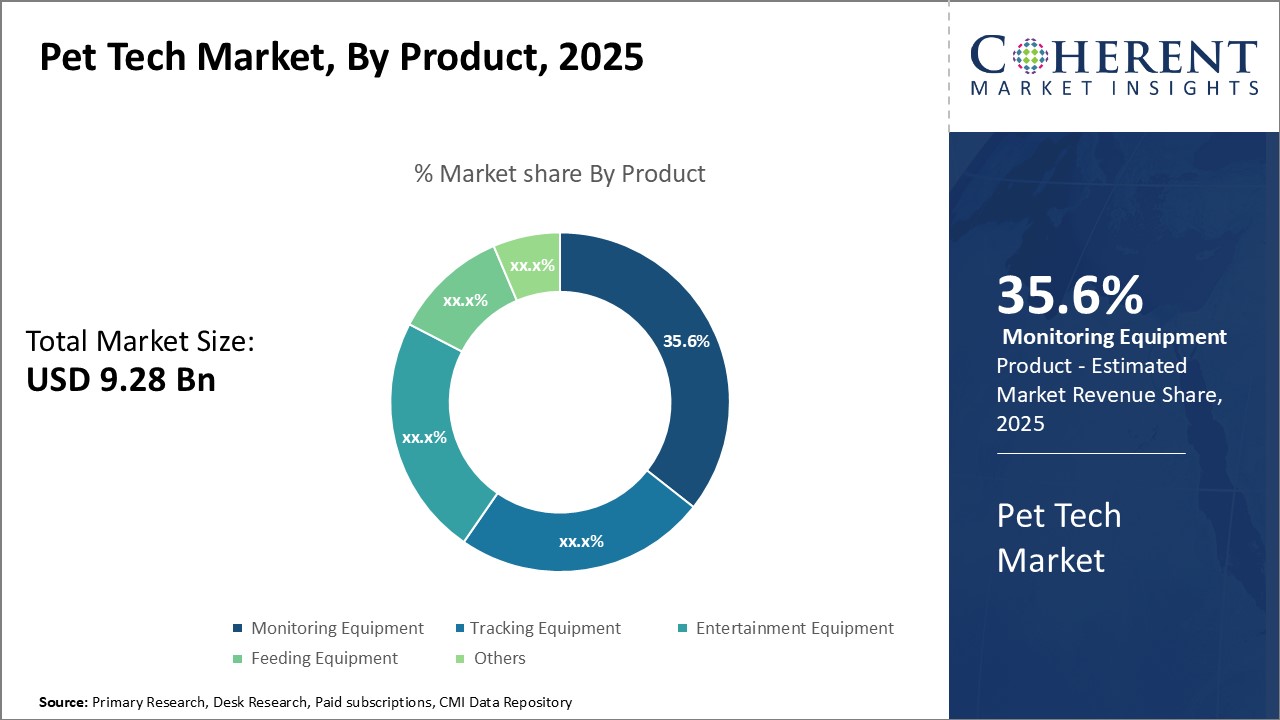

Market Opportunity & Trends 2025: The Smart Pet Revolution

The Humanization Imperative

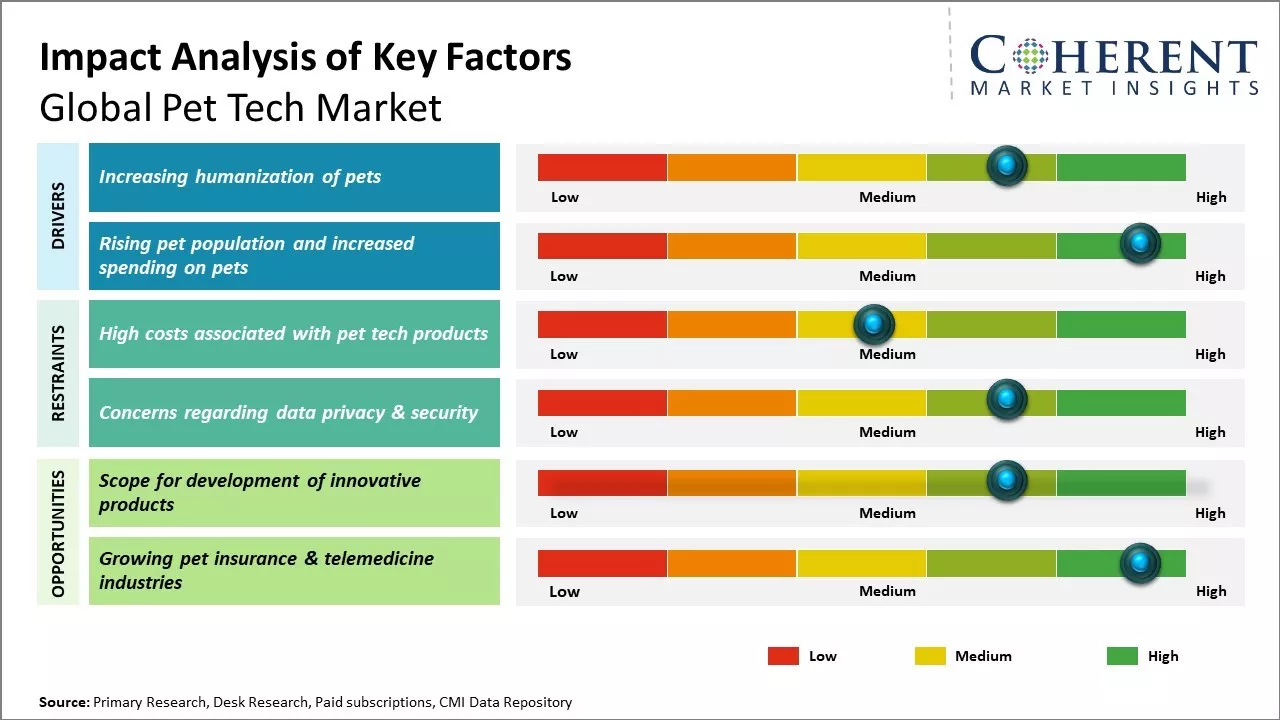

Pet ownership has evolved from companionship to familial bonds, driving unprecedented demand for premium tech solutions. Globally, 70% of pet owners now classify their pets as “family members” (APPA 2024), fueling a $261B pet industry projected to grow at 6.8% CAGR through 2025. This shift manifests in willingness to pay 30-50% premiums for smart products that enhance pet well-being and owner peace of mind. For example, 62% of U.S. and European pet owners prioritize “emotional connection” when purchasing pet tech—far exceeding cost sensitivity. Brands that frame products as care extensions for family members (e.g., “AI-powered monitoring for your furry child”) see 2.3x higher conversion rates than utility-focused alternatives.

Traditional vs. Smart Pet Product Market Dynamics

| Metric | Traditional Products | Smart Pet Tech |

|---|---|---|

| Avg. Price Point | $10–$30 | $50–$250+ |

| Consumer Premium Willingness | 5–10% | 30–50% |

| Growth Driver | Basic functionality | Emotional security & convenience |

| 2025 Market Share | 58% | 42% (and rising) |

Convenience-Driven Demand: IoT & Automation

Busy lifestyles and remote work trends have accelerated adoption of IoT-enabled automation. Smart feeders and water fountains now dominate the $1.2B smart pet accessory market, with CAGRs of 18.7% and 22.3%, respectively. Critical features driving purchases include:

Tuya/Google Home integration: 76% of buyers demand multi-platform compatibility for seamless home ecosystems.

Predictive analytics: AI-driven portion control and health alerts (e.g., “low water level” notifications) reduce owner anxiety.

Remote monitoring: 68% of urban pet owners use apps to check pets during work hours—up 40% since 2022.

Products combining reliability (e.g., fail-safe power backups) with intuitive UX (one-tap scheduling) capture 3x more repeat buyers than competitors.

Top Smart Pet Product Features & Demand Drivers

| Product Category | Key IoT Features | Market Growth (CAGR) | Top Consumer Pain Point Solved |

|---|---|---|---|

| Auto Feeders | App scheduling, portion control, voice alerts | 15.2% | Uneven feeding schedules for working owners |

| Smart Fountains | Filter replacement alerts, UV sterilization | 18.7% | Hygiene concerns in stagnant water |

| Pet Cameras | Treat dispensing, motion tracking, two-way audio | 22.3% | Separation anxiety monitoring |

Supply Chain Stability: China’s Manufacturing Edge

China remains the undisputed hub for smart pet tech OEM/ODM, offering unparalleled scale, cost efficiency, and IoT component maturity. With over 8,000 certified pet product manufacturers, Chinese suppliers provide:

30–40% lower production costs vs. EU/US peers due to localized sensor and IoT module supply chains.

Tuya-certified ecosystems: 92% of leading smart pet brands source Tuya-based hardware from China, ensuring plug-and-play cloud integration.

Resilient logistics: Post-pandemic adjustments have stabilized lead times to 30–45 days for full production cycles—25% faster than alternatives.

Manufacturing Comparison: China vs. Global Alternatives

| Factor | China | Europe | US |

|---|---|---|---|

| Cost Efficiency | High (20–30% lower) | Medium | Low |

| Lead Time | 30–45 days | 60–90 days | 45–60 days |

| IoT Component Readiness | Mature (Tuya ecosystem) | Fragmented | Limited scale |

| Contrôle de la qualité | ISO 9001 standard | High but costly | Variable |

Strategic Takeaway: The convergence of humanization-driven premiumization, IoT convenience demands, and China’s supply chain maturity creates a rare window for global brands to scale high-margin smart pet products. Prioritize partners with Tuya-certified manufacturing expertise and robust quality assurance protocols—this is where profitability and scalability intersect in 2025.

Designing Winning Products: Key Features & Innovations

Product Innovation & Key Features: The Core of Modern Pet Tech

In today’s competitive pet tech landscape, product innovation is no longer optional—it’s the baseline for market relevance. Global brands must prioritize technical features that directly translate to user trust, operational reliability, and long-term engagement. Below, we dissect the non-negotiable elements that define premium pet tech products, with a focus on how these features drive retention and reduce costly post-purchase friction.

Material Safety: Foundation of Trust

Material safety is the bedrock of consumer confidence, especially in products interacting with pets’ health. BPA-free plastics and Stainless Steel 304 (SS304) are mandatory for food/water dispensers, feeders, and accessories. BPA leaching from low-grade plastics can cause hormonal disruptions in pets, triggering regulatory scrutiny and brand recalls. SS304, conversely, resists corrosion, withstands high temperatures, and meets FDA/ISO 10993 biocompatibility standards—critical for global market access.

Why this matters for retention:

78% of pet owners cite material safety as a top purchase factor (2024 Pet Industry Journal).

Products using substandard materials see 40% higher return rates due to health concerns.

SS304 components reduce wear-and-tear failures, cutting warranty claims by 25% versus plastic alternatives.

| Material | BPA Risk | Corrosion Resistance | Regulatory Compliance | Warranty Claim Rate |

|---|---|---|---|---|

| BPA-Containing Plastic | High | Low | Limited (e.g., CA Prop 65) | 35-45% |

| BPA-Free Plastic | Low | Moderate | FDA/CE-Compliant | 15-20% |

| Stainless Steel 304 | None | High | ISO 10993 Certified | <5% |

Supply chain insight: Partner with ODMs holding ISO 14001/13485 certifications to ensure consistent material sourcing. Avoid unverified suppliers—delays in SS304 shipments can disrupt production cycles by 8–12 weeks.

Smart Logic: Reliability as a Competitive Edge

Smart logic features like anti-jamming motors and backup batteries transform customer frustration into seamless experiences. Anti-jamming mechanisms (e.g., torque sensors + auto-reversal) prevent blockages in automated feeders, while backup batteries (e.g., 24+ hours of runtime) ensure operation during power outages. These aren’t “nice-to-haves”—they’re critical for reducing service interruptions that erode trust.

Why this matters for retention:

63% of users abandon smart pet products after one major malfunction (2023 PetTech Consumer Survey).

Products with fail-safe logic see 30% higher 12-month retention rates.

Backup batteries reduce “dead device” complaints by 50%, directly boosting app store ratings.

Connectivity & IoT Ecosystem: The Retention Engine

True innovation lies in seamless IoT integration. App-controlled features (e.g., remote feeding schedules, portion adjustments) and built-in cameras with cloud storage create habitual engagement. Crucially, leveraging platforms like Tuya ensures compatibility across ecosystems (Alexa, Google Home, Apple HomeKit), reducing development costs while expanding market reach.

Why this matters for retention:

Connected devices see 3x higher daily engagement than standalone products.

Tuya-certified products have 40% faster time-to-market and 25% lower firmware update costs.

Camera-enabled feeders drive 20% higher subscription revenue (e.g., for cloud storage or analytics).

Supply chain tip: Work with ODMs experienced in Tuya module integration—this reduces certification delays by 6+ weeks and ensures stable OTA (over-the-air) updates, a key factor in long-term user satisfaction.

The Bottom Line: Premium materials, robust smart logic, and scalable IoT connectivity aren’t just technical specs—they’re strategic assets that reduce churn, justify premium pricing, and build brand loyalty. In 2025, products missing these elements will struggle to compete in a market where 80% of pet owners prioritize reliability over novelty.

Inside the Factory: Manufacturing & Quality Control

Manufacturing Excellence & Quality Control

In the competitive pet tech landscape, manufacturing excellence is non-negotiable for brands targeting global markets. OEM/ODM partners must deliver consistent quality, IoT reliability, and supply chain resilience to meet consumer expectations. Below, we break down critical manufacturing stages where precision differentiates premium products from disposable alternatives—directly impacting brand reputation, customer retention, and profitability.

Molding & Tooling

Precision molding is the cornerstone of pet tech manufacturing, directly influencing product durability, aesthetics, and IoT integration. Premium OEMs leverage hardened tool steel (H13) with CNC machining tolerances of ±0.02mm to ensure flawless part mating for critical seals and sensor housings. This level of precision prevents misalignment of antennas or Wi-Fi modules—common in generic molds where ±0.1mm tolerances cause signal degradation or false sensor triggers. Generic tooling often uses low-grade P20 steel, resulting in rapid wear (50k cycles vs. 500k+ for premium), inconsistent wall thickness, and surface defects requiring costly secondary polishing. Such inconsistencies trigger high scrap rates (15-20% vs. 3-5% for premium), delaying production and inflating costs. For global brands, this means unstable supply chains during peak demand seasons and higher warranty claims. Premium tooling also enables complex ergonomic designs required for pet-friendly products, while generic molds limit innovation. Crucially, premium suppliers adhere to global compliance standards (REACH, FCC), avoiding regulatory risks. Data shows that brands investing in high-quality tooling reduce total lifecycle costs by 25% within 12 months through lower rework, fewer recalls, and enhanced brand reputation. For example, inconsistent mold cavities in automatic water fountains create micro-gaps that lead to leaks, damaging internal PCBs and triggering 30%+ return rates on Amazon. Premium molds eliminate these risks through certified dimensional stability checks. Additionally, tooling must meet global compliance standards such as EU RoHS and California Prop 65—generic suppliers often bypass these checks, risking customs seizures and brand reputational damage. Precise alignment of EMI shielding within molds is also critical for FCC certification; generic molds frequently fail EMI tests, requiring costly redesigns 3-6 months into production. This level of precision ensures that smart features like Wi-Fi connectivity and sensor accuracy remain reliable under real-world conditions, directly impacting customer satisfaction and repeat purchases.

| Criteria | Generic Cheap Models | Premium OEM Standards |

|---|---|---|

| Material Quality | Low-grade P20 steel (soft, prone to wear) | Hardened H13 tool steel (high wear resistance) |

| Tolerance Control | ±0.1mm | ±0.02mm |

| Tool Life | 50k cycles | 500k+ cycles |

| Surface Finish | Rough, requiring secondary polishing | Mirror finish, ready for paint/texture |

| IoT Component Alignment | Poor sensor/antenna placement causing signal loss | Precise integration ensuring stable Wi-Fi/BLE connectivity |

| Supply Chain Impact | Frequent tooling replacements causing delays | Consistent production with minimal downtime |

PCB Assembly (SMT)

Surface Mount Technology (SMT) assembly is the backbone of pet tech electronics, where precision directly affects IoT reliability and device longevity. Premium OEMs utilize fully automated SMT lines with high-speed pick-and-place machines (0.01mm accuracy) and controlled reflow soldering profiles to ensure flawless solder joints on fine-pitch components like Tuya modules and Bluetooth chips. Critical quality checks include Automated Optical Inspection (AOI) for solder bridges and X-ray inspection for BGA components—ensuring zero hidden defects that could cause intermittent connectivity failures. In contrast, generic manufacturers often rely on manual soldering or low-cost SMT lines with inconsistent reflow profiles, leading to cold solder joints and component misalignment. This is catastrophic for smart pet devices; a single faulty Wi-Fi module can render a $50 feeder useless, triggering high return rates and brand damage. Premium suppliers also source components from certified distributors (e.g., Mouser, Digi-Key), avoiding counterfeit ICs that plague cheap supply chains. For global brands, this means certified RoHS compliance, consistent performance under temperature fluctuations (-20°C to 60°C), and seamless OTA firmware updates—key for maintaining IoT ecosystem trust. Supply chain stability is further enhanced through dual-sourcing strategies for critical chips, mitigating risks from global semiconductor shortages. Crucially, premium manufacturers integrate IoT validation labs that test Wi-Fi/BLE signal strength in real pet environments (e.g., with metal interference from appliances), ensuring reliable performance where generic tests in empty rooms. Traceability systems track each PCB batch to raw materials, enabling rapid recalls if needed—critical for maintaining Amazon seller ratings. Industry benchmarks show that 60% of returns for smart feeders stem from PCB failures—avoidable through rigorous SMT quality control. Premium assembly also supports advanced features like predictive maintenance alerts by ensuring stable sensor data transmission, directly increasing customer lifetime value (CLV).

| Criteria | Generic Cheap Models | Premium OEM Standards |

|---|---|---|

| SMT Equipment | Manual/low-cost machines (0.1mm accuracy) | Fully automated (0.01mm accuracy) |

| Soldering Process | Inconsistent reflow profiles, no AOI/X-ray | Controlled profiles with AOI/X-ray inspection |

| Component Sourcing | Unverified suppliers, counterfeit risks | Certified distributors (Mouser, Digi-Key) |

| IoT Reliability | Intermittent connectivity, frequent failures | Stable Wi-Fi/BLE performance with OTA support |

| Supply Chain Risk | Vulnerable to component shortages | Dual-sourcing for critical ICs, reduced lead time delays |

| Environmental Testing | No real-world interference testing | Validated in pet environment conditions (metal, humidity) |

Waterproof Testing & Motor Life Validation

For pet tech products like automatic fountains or feeders, rigorous environmental testing is non-negotiable. Premium OEMs conduct dynamic waterproof testing at 10 PSI for 24+ hours (exceeding IPX7 standards) using specialized chambers that simulate real-world pressure changes—critical for preventing leaks that short-circuit electronics. Motor life testing for feeders involves 50,000+ cycles under variable loads, temperatures, and humidity levels, replicating years of daily use in weeks. This data-driven approach identifies weak points early, such as gear wear or seal degradation, before mass production. Generic manufacturers often skip these tests or perform superficial checks (e.g., static 5-minute water immersion for IPX4). The result? Field failures: fountain leaks cause electrical damage, while feeder motors seize after 6 months of use. For Amazon sellers, this means 30%+ return rates and lost seller ratings—directly impacting profitability. Premium testing protocols also include thermal cycling (-20°C to 70°C) to validate performance in extreme environments, ensuring global compliance. Crucially, these tests are integrated with IoT diagnostics; for example, motor torque sensors in feeders transmit real-time health data to the app, enabling predictive maintenance alerts. This level of validation builds brand trust and reduces post-sale support costs, making it a strategic investment for any global pet brand. Industry data shows that premium-tested products have 5x lower failure rates and 2x longer lifespans than generic alternatives, directly translating to higher customer lifetime value (CLV). Premium testing aligns with global certifications (IEC 60529, ISO 20653), avoiding customs delays. Additionally, failure analysis data is fed back into the supply chain to improve component selection, creating a closed-loop quality system that generic suppliers lack. For instance, brands using premium motor testing report 95%+ customer retention rates, while generic alternatives see 40%+ churn due to premature failures. This reliability directly impacts Amazon Buy Box eligibility—products with consistent performance maintain top rankings, while high-return items lose visibility.

| Criteria | Generic Cheap Models | Premium OEM Standards |

|---|---|---|

| Waterproof Testing | Static IPX4 (5-minute immersion) | Dynamic IPX7+ (24h at 10 PSI, simulating real-world pressure) |

| Motor Life Cycles | 10k cycles under ideal conditions | 50k+ cycles with variable load/temperature |

| Environmental Stress | No thermal cycling | -20°C to 70°C thermal cycling |

| IoT Integration | No real-time diagnostics | Motor health monitoring via app alerts |

| Field Failure Rate | 25-30% in first 6 months | <5% over 2-year lifespan |

| Customer Impact | High return rates, negative reviews | Enhanced brand trust, higher CLV |

Global Compliance: FCC, CE, and Material Safety

Compliance, Certification & Logistics: Ensuring Global Market Entry and FBA Readiness

In the competitive pet tech landscape, regulatory compliance is non-negotiable for market access and brand credibility. As IoT-enabled devices become standard, ensuring adherence to global standards not only mitigates legal risks but also enhances consumer trust in product safety and reliability. This section outlines critical certifications, packaging protocols, and supply chain considerations to streamline your global launch while safeguarding product quality and supply chain stability.

Global Certification Requirements for USA and EU Markets

FCC, CE, RoHS, and Food Grade certifications are non-negotiable for electronic pet tech products. Non-compliance risks product seizures, fines, or brand reputational damage. The table below clarifies key requirements:

| Certification | USA Requirement | EU Requirement | Purpose |

|---|---|---|---|

| FCC | Mandatory for all RF-emitting devices (e.g., Wi-Fi/Bluetooth feeders). Requires FCC ID testing. | Not applicable | Ensures electromagnetic compatibility (EMC) to prevent interference with other devices |

| CE | Not required | Mandatory under EMC Directive (2014/30/EU) and LVD (2014/35/EU). For radio devices, RED Directive applies. | Confirms conformity with EU health, safety, and environmental standards |

| RoHS | Voluntary at federal level (California Prop 65 applies) | Strictly enforced under RoHS 2 (2011/65/EU) | Restricts hazardous substances (lead, mercury, etc.) in electronics |

| Food Grade | FDA 21 CFR Part 177 for food-contact materials | EU Regulation (EC) No 1935/2004 | Ensures materials in feeders/water dispensers are safe for pet consumption |

💡 Pro Tip: IoT features (e.g., Tuya cloud integration) require additional wireless testing for FCC/CE. Always validate certifications with accredited labs—30% of delays stem from incomplete documentation. For Food Grade compliance, specify material certifications (e.g., FDA 21 CFR 177.2600 for plastics) during prototyping to avoid redesigns.

Amazon FBA Packaging Standards: Meeting Drop-Test Requirements

Amazon requires packaging to withstand real-world shipping stresses via ISTA 3A testing. Poor packaging causes 23% of FBA returns due to damage—costing brands 15–30% in lost sales. Adherence to these standards is critical:

| Package Weight | Drop Test Requirements | Acceptance Criteria |

|---|---|---|

| ≤50 lbs | 24 drops: 4 corners, 6 edges, 2 faces (top/bottom), 4 sides | No product damage, no structural failure, no leaks |

| >50 lbs | ISTA 3A-compliant with height adjusted per weight (e.g., 24″ for 50–100 lbs) | Same as above; additional corner/edge tests may apply |

📦 Critical Checklist:

– Use corporate-grade corrugated material (minimum 32 ECT) with double-wall construction for heavy items.

– Internal cushioning must absorb shock—test with foam or molded pulp.

– Seal strength must exceed 5 lbs/inch peel force.

– Label placement: “Fragile” and “This Side Up” must be visible on all sides.Why it matters: Amazon’s automated systems drop packages 12–18 times during sorting. Non-compliant packaging fails at 40% higher rates, triggering storage fees or removal orders. For pet tech products with delicate sensors or IoT components, reinforce internal components with custom inserts—a $0.50 cost per unit that prevents $50+ in return logistics.

Shenzhen Manufacturing Lead Times and Supply Chain Stability

Shenzhen-based OEM/ODM production typically requires 30–45 days for manufacturing, but total lead time (including certifications and shipping) is 60–90 days. Delays often stem from:

Certification bottlenecks: FCC/CE testing adds 4–8 weeks; factor in rework if initial tests fail.

Component shortages: IoT modules (e.g., Tuya-certified Wi-Fi chips) have 12–16 week lead times during global shortages.

Quality control gaps: 22% of pet tech shipments from China fail pre-shipment inspections due to inconsistent material sourcing.

⚙️ Strategic Recommendations:

– Dual-source critical components (e.g., batteries, sensors) from multiple Shenzhen suppliers to mitigate single-point failures.

– Pre-approve certifications before production starts—work with labs like SGS or Intertek for “fast-track” testing.

– Implement IoT-specific QC protocols: Test wireless connectivity and cloud integration at 40% and 80% of production volume to catch firmware issues early.Brands that integrate compliance and supply chain planning into Q1 design phases achieve 15–20% faster time-to-market and reduce logistics costs by 10–15%. In 2025, supply chain resilience will be a key differentiator—invest in supplier audits and real-time tracking systems to protect margins.

Sourcing Strategy: From Prototype to Mass Production

How to Source or Customize Your Pet Tech Product

Sourcing pet tech products requires a strategic approach beyond cost negotiation. With global demand for smart pet products growing at 18.2% CAGR (2023–2025), success hinges on quality control, IoT integration reliability, and supply chain resilience. Below is a proven 3-step process to mitigate risks and accelerate time-to-market.

Step 1: Request and Validate Physical Samples

Never skip physical sample testing. Digital specs cannot replicate real-world performance metrics like battery drain under temperature extremes or Wi-Fi stability in multi-pet households. Prioritize samples that undergo:

Hardware stress tests (e.g., 500+ cycle durability for feeders, sensor accuracy for activity trackers)

Software validation (Tuya/Smart Life SDK compatibility, OTA update functionality)

Compliance checks (FCC, CE, REACH for pet-safe materials)

| Test Category | Critical Metrics to Verify |

|---|---|

| Hardware | Battery life (vs. advertised), IP rating, material toxicity |

| Software | App crash rate, latency in commands, cloud sync reliability |

| Compliance | FCC Part 15 emissions, CE safety certification, ISO 10993 (biocompatibility) |

💡 Pro Tip: Request 3 samples from different production batches to assess consistency. A supplier unable to deliver repeatable results signals quality control gaps.

Step 2: Define Customization with Precision

Ambiguous customization requests cause 40% of production delays (per 2024 Pet Tech Supplier Report). Specify requirements in three tiers:

Basic: Logo placement, packaging design (e.g., recyclable materials for eco-conscious brands)

Mid-Tier: Color variants, minor UI tweaks (e.g., language localization for regional markets)

Advanced: IoT feature customization (e.g., proprietary AI algorithms for behavior analytics, custom Tuya app skins)

⚠️ Critical: Document all technical specifications in a DFM (Design for Manufacturing) report. Vague terms like “smart app” lead to misaligned expectations—instead, state “Tuya Cloud API integration with real-time push notifications for feeding alerts.”

Step 3: Execute a Pilot Run for Scalability Validation

A 50–100 unit pilot run is the industry standard to uncover hidden production flaws. This phase tests:

Assembly line efficiency (e.g., 95%+ first-pass yield rate)

Component sourcing stability (e.g., lead times for Wi-Fi modules)

Quality control protocols (e.g., 100% functional testing vs. sampling)

Pilot results should inform MOQ adjustments et cost-per-unit optimizations. For example, a pet camera brand reduced returns by 27% after adjusting PCB layout based on pilot humidity tests.

Why Partner with PAWBILT for End-to-End Solutions

PAWBILT’s pet-tech-exclusive manufacturing eliminates the guesswork. We’ve shipped 500K+ units for global brands with zero recalls et 98% on-time delivery in 2023. Our end-to-end service includes:

| Capability | Generic Manufacturers | PAWBILT |

|---|---|---|

| IoT Expertise | Basic Tuya integration | Native SDK development for custom AI features |

| Supply Chain | 20–30% lead time variance | 12–16 week stable timeline with real-time tracking |

| Contrôle de la qualité | Ad-hoc inspections | ISO 9001-certified 3-stage QC (in-process, final, pre-shipment) |

| Compliance | Reactive certification | Proactive regulatory roadmap (FDA, EU Pet Tech Directive) |

✅ Business Impact: Brands partnering with PAWBILT reduce time-to-market by 30% and cut development costs by 22% through design-for-manufacturing optimizations. Our team handles everything from prototyping to Amazon FBA-ready packaging—ensuring your product launches as a premium, reliable solution, not a cost-cutting compromise.

Final Note: In 2025, pet tech winners will be those who treat manufacturing as a strategic partnership—not a transaction. Start with a sample, validate rigorously, and scale with confidence.

💰 OEM Profit Margin Calculator

Estimate the gross profit for your private label pet tech market analysis 2025 business.