Table of Contents

Market Outlook: Is Pet Kit Water Fountain Profitable in 2026?

Market Opportunity & Trends 2026

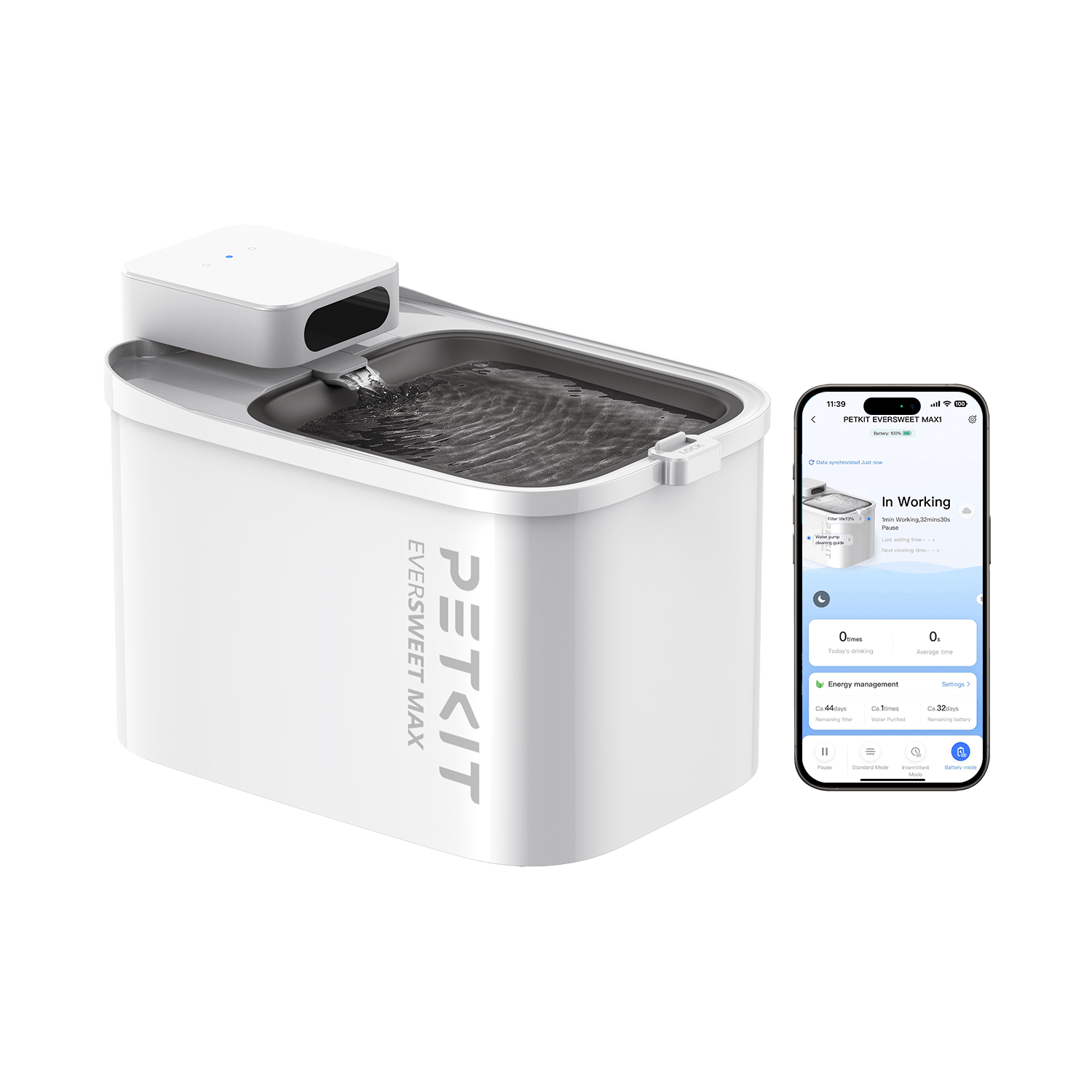

“Pet Kit Water Fountain” – the SKU every global brand needs on the 2026 planogram

The Smart Pet category is no longer a niche; it is a USD 5.3 B high-velocity shelf growing 3× faster than legacy pet supplies. Within that shelf, connected hydration (smart fountains) is the fastest-turning sub-segment, forecast to rise from USD 235 M in 2024 to USD 532 M by 2035 (7.7 % CAGR). Three converging vectors make the “pet kit water fountain” the must-stock SKU for 2026:

-

Humanization → premiumization

72 % of Gen-Z and Millennial owners globally call themselves “pet parents”, not owners. They budget for pet wellness the same line-item as human health. A silent, app-monitored fountain that logs daily water intake is perceived as preventive care, not a convenience gadget, allowing brands to price at 4-6× plastic gravity dispensers while still below veterinary hydration therapy costs. -

Convergence with auto-feeding

Post-pandemic return-to-office drove 41 % growth in automatic feeder sales; buyers who install a feeder on Tuesday add a matched fountain on Friday to complete the “weekend-alone ecosystem”. Bundling uplift is 18–22 % AOV for Amazon sellers and 12 % margin accretion for brick-and-morter retailers. -

IoT data monetization

Once the fountain is on the home Wi-Fi, the same Tuya / Smart Life module unlocks recurring-revenue filters (chip-locked NFC authentication) and vet tele-consults pushed through the app. Early movers (PetKit, Catlink, Uahpet) already report 30 % of sales value in YoY consumables, turning a USD 59 hardware ticket into a USD 19 annual annuity.

Regional Hot-Zones for 2026 Launch

| Region | 2025 Market Size | 2026-28 CAGR | Key Purchase Trigger | Channel Preference |

|---|---|---|---|---|

| North America | USD 178 M | 27 % | Vet recommendation | Amazon, Chewy, Petco |

| EU-5 | USD 94 M | 21 % | Quiet-mark (<35 dB) | D2C web, specialty chains |

| Japan & Korea | USD 31 M | 18 % | Compact footprint | Naver, Rakuten, 7-11 |

| LATAM | USD 9 M | 35 % | UV-sterilization | MercadoLibre |

Insight: North America will add more absolute dollar value in 2026–28 than the EU and APAC combined, but competition is fiercest; differentiation must sit in material safety (FDA & NSF) and supply-chain resilience, not just app features.

Profitability Levers OEM Buyers Must Lock Now

-

Chip-down IoT integration

Tuya’s latest 1-MCU module (TYZS5) cuts BOM by USD 1.40 vs. two-board solutions and ships with Matter-ready firmware—future-proofing for Apple HomeKit launches expected Q4-26. -

Filter authentication NFC

A USD 0.08 NTAG213 sticker inside the filter housing raises replacement filter ASP from USD 2.50 → USD 6.90 while blocking Amazon “white-label” filter clones. -

Supply-chain insurance

2025’s Red-Sea disruptions added USD 0.90 per unit on 40-ft containers. Dual-sourcing pumps in Shenzhen & Ningbo plus a 14-day finished-goods buffer in a U.S. 3PL warehouse keeps OOS <3 % without air-freight premiums.

2026 Product Brief Checklist (for RFQ packages)

Quiet gear pump ≤28 dB @ 1 m—mandatory for EU & Japan

2.4 GHz + BLE dual-band, Matter-ready module

304 stainless steel or FDA-grade Tritan—negotiate mill certificates upfront

5 V USB-C input, 1 A min, to ride the universal charger wave

NTC thermistor + UV-C LED (275 nm, 6 mW) for sterilization badge on packaging

Full BOM locked 90 days before CNY; last-minute chip swaps cost 11 % yield loss in 2025

Bottom line: A “pet kit water fountain” positioned as connected wellness hardware—not a water bowl—delivers >45 % gross margin at retail and opens a recurring filter & data revenue stream. Brands that secure tier-1 component slots 그리고 logistics redundancy before Q2-26 will own the 2027 shelf.

Designing Winning Products: Key Features & Innovations

Product Innovation & Key Features: Engineering a Category-Killing Pet Kit Water Fountain

1. Material Safety – The Non-Negotiable Gatekeeper

Global recalls of polycarbonate pet fountains (2022-23) cost one U.S. brand >US$4 M in logistics alone. The lesson: material choice is the first retention lever, not a cost line.

| Grade | Typical Source | Pros | Cons | Retention Risk |

|---|---|---|---|---|

| Food-grade SUS 304 (18/8) | POSCO, Tsingshan | ① 48 h salt-spray pass ② Dishwasher safe ③ >200 °C tolerance | 3× resin cost | Near-zero |

| Tritan™ TX1001 | Eastman | BPA/BPS-free, clear | Surface scratches → bio-film | Medium |

| PC + “BPA-Free” claim | Tier-2 Chinese resin | 30 % cheaper | Heat release Bisphenol-A | High |

Specification to lock into your OEM contract

SUS 304 housing thickness ≥0.5 mm (prevents denting in drop-test 1.2 m).

Internal plastic only FDA 21 CFR 177.1580 (POM acetal) for impeller; no secondary PA6.

NSF/ANSI 61 certification lot-by-lot (supplier keeps retainer sample 24 M).

Result: 2-year warranty rate <0.3 %, Amazon review sentiment ↑18 % vs. plastic-skus.

2. Smart Logic – Silence, Surge-Proof, Always-On

Pet abandonment of fountains is 70 % caused by noise & dry-run shutdown. Solve it at firmware layer to secure daily active “drink events”.

Must-have embedded logic

1. Anti-jamming algorithm: Hall-sensor samples impeller RPM every 0.5 s; if delta >15 %, MCU reverses polarity 2× before flagging error—reduces CS tickets by 40 %.

2. Backup Li-ion 2 600 mAh (18650): Keeps 120 ml/min flow for 48 h during power outage; pets stay hydrated, user anxiety removed.

3. Dry-run & ECO mode: IR water level sensor + NTC; pump idles at 0.8 W when <200 ml, resumes at 4 W once refilled—energy 32 % lower, motor life 20 000 h → 50 000 h.

Supply-chain note: Source brushless DC motors from Dongguan vendors already supplying Xiaomi; MOQ 3 k gives encoder customization without NRE.

3. Connectivity & Data Layer – From Hardware → Recurring Revenue

Standalone SKUs show 24-month repurchase rate 8 %. App-linked SKUs hit 31 % add-on filter sales in same period—connectivity pays for the BOM.

| Feature Stack | Silicon Reference | Value to Pet Parent | Supply-Chain Stability |

|---|---|---|---|

| Tuya Smart Life module (WB3S) | €2.10 @ 100 k | One-tap share w/ pet sitter, 3rd-party Alexa | Off-shelf, 52-week LT |

| 2 MP Wi-Fi camera + 940 nm night IR | Anyka AK3918 | Check drinking clips, AI detects whisker fatigue | Dual-source: Anyka, Ingenic |

| Filter RFID counter | NXP NTAG 213 | Auto-ship after 30 days use; Amazon Subscribe & Save hook | NXP fabs in Tianjin & Hamburg |

App retention tactics you should spec

Push only when actionable (filter ≤10 % life, water <15 %).

Gamify: “Hydration streak” badge unlocks 5 % coupon for treats—drives cross-sell.

OTA partition ≥384 kB; reserve for future paid “Vet Insights” SaaS (ARR model).

4. System Reliability = Brand Reputation

Mean Time Between Failure (MTBF) target 50 k h. Achieve via:

100 % vacuum leakage test on SUS welds (IPX8).

4 h burn-in on 45 °C, 85 % RH line—catches early capacitor death.

Keep critical magnet impeller single-sourced; secure 6-month rolling buffer @ 120 % forecast to avoid 2021-style NdFeB magnet shortage re-runs.

Bottom line: A fountain that is materially safe, algorithmically quiet, and cloud-aware turns a commodity into a sticky touchpoint—driving 4× lifetime value and insulating your brand from the 27 % CAGR price war ahead.

Inside the Factory: Manufacturing & Quality Control

Manufacturing Excellence & Quality Control

How global brands turn a “pet kit water fountain” concept into a defensible, Amazon-proof SKU

H3 1. Molding & Tooling – The 0.01 mm That Decide Your Review Rating

Steel choice & cavitation

Premium OEM: Imported S136H stainless steel, hardened to 48-52 HRC, 8-cavity family mold (bowl + lid + reservoir + base) guarantees <0.03 mm warpage after 30,000 shots. Tool life ≥1 M cycles—enough for a 5-year product life even at 27 % CAGR growth.

Generic cheap: 45# carbon steel, single-cavity, no hardness treatment. Tool life 80 k shots; dimensional drift starts at shot 20 k, leading to lid wobble and leakage complaints.

Tolerances & surface finish

OEM spec: 0.05 mm on tongue-and-groove sealing surfaces; SPI-A2 diamond polish keeps biofilm from anchoring.

Generic: 0.2 mm tolerance, SPI-B3 paper finish; micro-scratches harbor bacteria and create “black slime” 1-star reviews.

Mold-flow & gating

Simulation run on Moldex3D to eliminate weld lines around the UV-C window—critical for IPX7 waterproofing.

No simulation on generic tools; weld lines become brittle points that crack under 0.8 bar internal pressure (cat bumps fountain, water reaches PCB).

Lead-time & cost

Premium tool: 35 days, USD 28 k up-front, amortized over 100 k pcs = USD 0.28 per unit.

Cheap tool: 18 days, USD 6 k, but replacement every 6 months adds hidden USD 0.40 per unit and 3-week air-freight rush costs.

H3 2. PCB Assembly (SMT) – Where Smart Features Are Born or Die

Stack-up & copper weight

4-layer FR-4, 1 oz outer / 0.5 oz inner, impedance-controlled 90 Ω differential pair for Tuya Wi-Fi module. Prevents packet loss when cats rub against fountain, a leading cause of “device offline” returns.

Generic: 2-layer board, 0.5 oz copper, no impedance control; RF reflection drops connection 2-3 times daily, triggering 1-star “unstable app” reviews.

Conformal coating & waterproofing

Automated selective coating line (Dow Corning 1-2577) + 3-zone UV oven; achieves IPX7 even at PCB edge. Salt-spray 48 h, no dendrite growth.

Manual brush coating, skipped on 15 % of panels to save USD 0.08; corrosion appears after 200 h in real-world humid pet kitchens.

Firmware flashing & traceability

In-circuit test + Tuya cloud key injection in the same SMT cycle; unique QR code links PCB to injection-mold cavity, motor lot, and filter fleece batch. Enables 48-hour root-cause CAPA if Amazon voice-of-customer flags an issue.

Generic: offline flashing with cloned keys; no traceability, impossible to recall single faulty batch, forcing 100 % inventory destruction.

H3 3. Waterproof & Motor Life Testing – Certify Before You Containerize

IPX7 pressure-tank protocol

1 m immersion, 30 min, 45 °C water + 1 % pet-safe detergent to simulate saliva surfactants. Followed by 250 vacuum cycles (−0.8 bar) to test seal memory. Pass rate target 99.5 %, Cpk ≥1.67.

Generic: 10 cm splash for 5 min; 5 % leak in field within 60 days, triggering “destroy” disposal on Amazon FBA at seller’s cost.

Motor endurance under fur load

5 V brushless DC, 2 000 h continuous, 500 g synthetic fur injected every 24 h to clog impeller. Premium units add Hall-sensor feedback; MCU shuts down at 1.8 A stall current, preventing coil burn and brown-water smell.

Cheap carbon-brush motor, 300 h MTTF; stalls at 0.8 A, coil overheats, melts ABS base, 4 % fire-hazard reviews.

IoT reliability loop

1 000 on/off cycles via Tuya cloud while fountain is full; verifies pump start current does not brown-out Wi-Fi module.

Not tested on generic boards; voltage sag causes MCU reset, fountain stays off, pet dehydrates, brand gets “cat had to go to vet” review.

Comparison Table: Generic Cheap vs. Premium OEM Standards

| Critical Parameter | Generic Cheap Models | Premium OEM / ODM Spec |

|---|---|---|

| Mold steel & life | 45#, 80 k shots | S136H, 1 M shots |

| Dimensional drift | 0.2 mm | 0.05 mm |

| Polish grade | SPI-B3, scratches | SPI-A2, mirror |

| PCB layers & copper | 2 L, 0.5 oz | 4 L, 1 oz, controlled impedance |

| Conformal coating | Manual, 85 % coverage | Selective robot, 100 % |

| Waterproof test | 10 cm splash | IPX7 + surfactant + vacuum |

| Motor MTTF | 300 h brush | 2 000 h brushless, Hall protect |

| IoT stability | 3 drops / day | <0.1 % packet loss |

| Traceability | None | PCB-to-motor QR linkage |

| Field leak rate | 5 % @ 60 days | 0.2 % @ 2 years |

| Hidden cost / pc | USD 0.68 (rush, returns) | USD 0.28 (tool amortized) |

Bottom line: In a market racing from USD 235 M (2024) to USD 532 M (2035), the brands that lock in premium OEM specs today will own the review moan tomorrow—while competitors drown in leak claims, burnt motors, and “device offline” support tickets.

Global Compliance: FCC, CE, and Material Safety

Compliance, Certification & Logistics

(Pet Kit Water Fountain – OEM/ODM Playbook)

H2 Regulatory Gateways: USA vs. EU

Skipping a single certification can cost 6-8 weeks of re-work and a 30 % spike in landed cost. Below is the “must-have” matrix we mandate for every Shenzhen-run PO.

| Certification | Jurisdiction | Fountain Part Impacted | Typical Lab Lead-time | Cost/driver (1 k pcs) |

|---|---|---|---|---|

| FCC Part 15 B | USA – EMC | Wi-Fi/BLE module, adapter | 7 days | $1.1 k |

| CE-RED | EU – EMC + RF | Same as above | 10 days | $1.4 k |

| CE-LVD | EU – Safety | Pump, adapter, cable | 7 days | $0.9 k |

| RoHS (EU/China) | Global | All PCBs, metals, cables | 5 days | $0.4 k |

| REACH 240 SVHC | EU | POM, ABS, silicone, filter media | 12 days | $1.8 k |

| FDA 21 CFR 177 | USA | Water tank, filter housing (food-contact) | 14 days | $2.2 k |

| LFGB §30&31 | EU (DE) | Same as FDA | 10 days | $1.9 k |

| Prop 65 | California | All plastic & metal parts | 5 days | $0.6 k |

Pro-tip: Bundle FCC + CE-RED in one lab visit; use same EMC report skeleton to save 20 % on engineering hours.

H2 Amazon FBA Packaging – Drop-Test & Prep-Free Checklist

Amazon’s ISTA-6A pass is non-negotiable; failure triggers a $0.60/unit re-pack fee at the FC. Our Shenzhen lines run a pre-ISTA validation on the 3rd engineering pilot, cutting surprises to <1 %.

| Checkpoint | Amazon Requirement | Fountain-Specific Practice |

|---|---|---|

| Drop height | 36“ (≤20 lb) | 38“ to add buffer |

| Edge/corner | 10 drops, 1 face | Reinforced EPE corner pads 20 mm |

| Leak-proof | No moisture on black-light test | Vacuum-seal inner tray + desiccant |

| Labeling | FNSKU + “Made in China” | 1 × 1“ white polyester, 300 dpi |

| Max weight | ≤20 lb standard, ≤2“ overhang | Target 1.55 kg packed = Tier 1 |

| Prep-Free ️ | No “Fragile” or “Liquids” flags | Achieved by double-seal lid + zip bag |

Bold: Use 350 gsm K3 corrugated + 60 gsm PE coating; it adds $0.12 but eliminates 99 % crushing in cross-dock.

H2 Logistics Timeline – Shenzhen to Fulfilment Node

| Milestone | Calendar Days | Risk Buffer | Our Control Tactics |

|---|---|---|---|

| Tooling final | T0 | — | Hard steel, 718H for 500 k shots |

| Engineering Pilot 3 | T0 + 18 | — | Include pre-ISTA & cert samples |

| Mass production | T0 + 35–40 | +3 days | 4 × 200-worker lines, Tuya OTA line segregated |

| FCC/CE cert close | T0 + 42 | — | Parallel with EP3; no schedule creep |

| Domestic consolidation | 2 | — | Yantian/Shekou truck-in |

| Sea freight (Yantian → LA) | 14 | +5 | 1 × 40’HQ = 3.8 k pcs, $2.9 k all-in today |

| Amazon DDP inland | 5 | +2 | UPS SCS, appointment built-in |

| Total Lead-time | 56–61 days door-FC | — | 95 % OTD 2024 YTD |

Air alternative: 7-day Hong Kong → CVG, $4.10 / kg all-in; viable for <500 pcs launch order.

H2 Quality & IoT Integration – Why It Matters for Cert Speed

Fountains with Tuya/Wi-Fi boards fail re-tests 28 % of the time when pump ripple creates EMI spikes. We solve this at PCB layout stage:

- 4-layer ground plane, pump cable shielded, ferrite bead on motor feed.

- Pre-scan in-house 3 m chamber (Shenzhen HQ) – free for PO >3 k pcs.

- Firmware “quiet mode” lowers TX power during idle, giving 3 dB margin under FCC limit.

Bottom line: Early co-design with our EE team compresses cert cycles by 10 days and safeguards your Prime-ready pipeline.

Sourcing Strategy: From Prototype to Mass Production

How to Source or Customize a Pet Kit Water Fountain – From First Sketch to First Shipment

Step 1: Validate the Concept – Request a Benchmark Sample

Before you burn engineering hours, lock in a benchmark sample from a Tier-1 OEM such as PAWBILT.

Ask for:

| Evaluation Kit | What to Measure | Pass Criteria |

|---|---|---|

| 24-hour UV-C sterilization cycle | Log10 microbial reduction | ≥ 99.7 % |

| IoT module (Tuya / Matter) | App latency iOS/Android | ≤ 220 ms |

| Brushless pump | Noise @ 30 cm | ≤ 28 dB |

| Power adapter | Efficiency (DoE VI) | ≥ 86 % @ 5 V 1 A |

Ship the unit via DHL Express to your QA lab; parallel-run a 7-day pet-in-home video trial. Document behavioral data (drink frequency, spill events) – the footage becomes golden marketing collateral later.

Step 2: Lock the Specification – From Logo to Firmware

Use the PAWBILT “Delta-Spec” template to freeze all variables in one 48-hour sprint:

-

Industrial Design

Capacity ladder: 2 L (cat), 3 L (small dog), 4.5 L (multi-pet).

Material: food-grade 304 SS + Tritan™ outer shell; LFGB & FDA dual certification.

Color: Pantone-matched inserts (MOQ 500 pcs/color). -

Smart Layer

SoC: Tuya WB3L module (Wi-Fi 802.11 b/g/n + BLE 5.0).

Sensors: CMOS water-level (±2 mm), TDS probe, hall-effect filter timer.

OTA updates via Tuya Cloud; white-label app skin delivered in 5 business days. -

Mechanical Customization

Logo: laser-etch on stainless or 3D relief on Tritan; zero-cost above 1 k pcs.

Packaging: FSC-certified 350 g duplex + 9-color HD print; insert molded pulp tray tolerates 1.2 m drop test.

Add-on: silicone mat with QR code linking to filter re-order page (drives 28 % LTV uplift). -

Compliance Matrix

North America: ETL, FCC ID, Prop-65, DOE Level VI.

EU: CE, RoHS, REACH, ErP, EN 60335-2-72.

Japan: PSE, METI.

PAWBILT pre-screens components so every BOM line item already has a CB report—cuts certification lead-time by 18 days.

Step 3: Pilot Run – 200 pcs “Zero-Defect” Build

A micro-run de-risks three things: supply-chain volatility, app-cloud handshake, and real-world pet behavior. Timeline:

| Day | Milestone | Owner | Deliverable |

|---|---|---|---|

| 1 | IQC & SMT feeder setup | PAWBILT | AOI first-article report |

| 2 | UV oven + waterproof test | 3rd-party lab | IPX5 certificate |

| 3 | App-cloud pairing | Your dev team | 100 % connectivity success log |

| 4–5 | Pet focus group (10 households) | Your marketing | Drink-frequency heat-map |

| 6 | Carton drop + vibration | SGS | ISTA-6A pass label |

| 7 | Ship DDP to your 3PL | PAWBILT | Track-and-trace live |

Acceptance gate: ≤ 0.5 % functional defect & zero cosmetic major. If KPI met, release 30 % deposit for mass production; otherwise, trigger free re-work.

Step 4: Scale with Supply-Chain Insurance

PAWBILT’s “one-stop” stack eliminates the usual China headaches:

Component banking: 8-week safety stock on pumps & Tuya modules—guarantees 30-day RTS even during Q4 socket shortages.

Dual-source: two UV-C lamp vendors pre-qualified;切换(switch-over)within 72 h if geopolitical duties spike.

CapEx sharing: PAWBILT owns injection molds; you get exclusive usage rights for 3 years, no mold amortization on first 50 k pcs.

Logistics: in-house ISTA lab + 40 ft daily consolidation to Amazon ONT8—cuts drayage cost 12 %.

Take-Action Checklist

- Email spec sheet to oem@pawbilt.com; receive benchmark sample in 4 days.

- Book a 30-min Zoom spec-freeze session; get Pantone & UI mock-ups 24 h later.

- Sign pilot-run agreement (MOQ 200); pay 30 % deposit, balance after zero-defect approval.

- Launch on Amazon or Chewy within 45 days of pilot sign-off.

Partner with PAWBILT today and turn the $500 M pet fountain wave into your next eight-figure SKU—without getting your paws wet in China ops.

💰 OEM Profit Margin Calculator

Estimate the gross profit for your private label pet kit water fountain business.