Table of Contents

Market Outlook: Is Pet Product Trends 2025 Profitable in 2025?

Market Opportunity & Trends 2025: Smart Pet Tech Growth Drivers

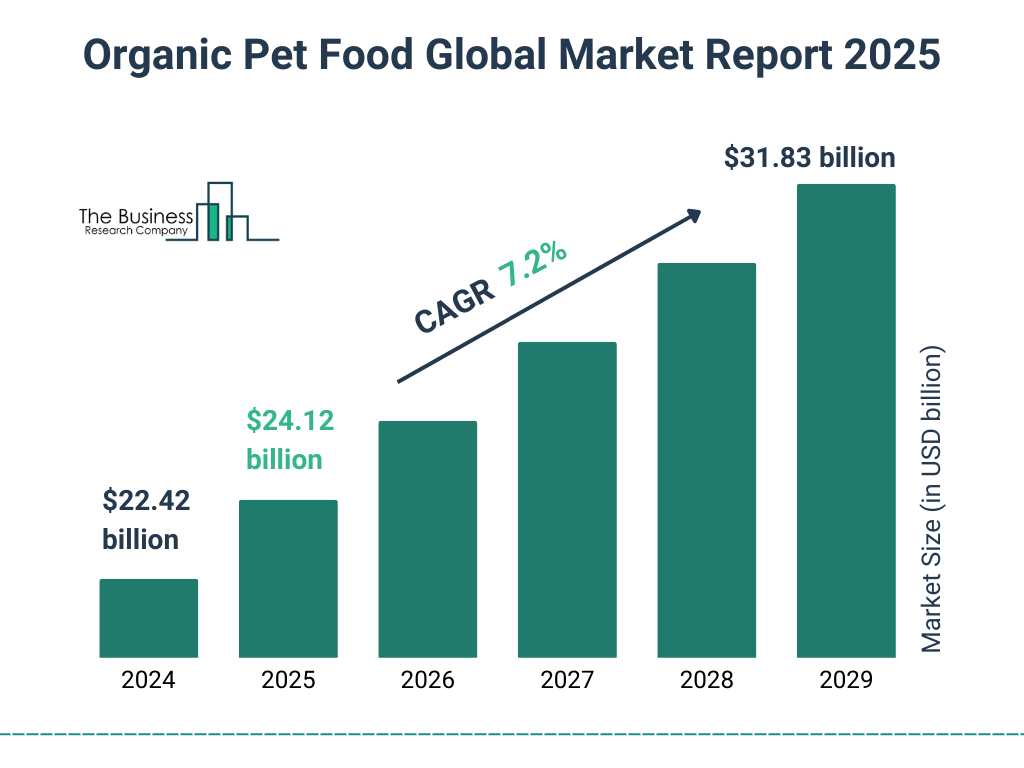

The smart pet technology sector is experiencing exponential growth, driven by humanization trends и convenience-driven innovation. With global pet product spending projected to reach $500 billion by 2030 (Clarkston Consulting), and the U.S. market accounting for 40% of this value, smart feeders, automated water fountains, and IoT-enabled accessories are no longer niche products—they’re mainstream essentials for modern pet owners. Brands that prioritize product quality, seamless IoT integration, and supply chain resilience will capture the highest margins in this high-growth segment.

Humanization Drives Premium Smart Product Adoption

Pets as family members is the cornerstone of this market shift. According to the APPA 2025 State of the Industry Report, 70% of U.S. pet owners view their pets as “family,” with millennials and Gen Z leading the charge—65% prioritize smart features over traditional pet products. This mindset fuels premium pricing: high-end smart feeders with AI-driven portion control and health monitoring commands 30% price premiums over basic models. Demand is further amplified by rising disposable incomes и post-pandemic wellness focus—pet owners now seek proactive care solutions, such as real-time activity trackers and automated feeding systems that integrate with smart home ecosystems.

Convenience Demand Fuels Smart Feeder & Fountain Market

Auto-feeding and hydration solutions are the fastest-growing subcategory, with a 18% CAGR (Packaged Facts). Amazon sellers report 4.5+ average ratings for IoT-enabled feeders with reliable app connectivity, while products lacking smart features see 20% higher return rates. Critical success factors include:

Tuya-based systems for seamless app control (e.g., remote feeding schedules, low-food alerts)

Fail-safe mechanisms like moisture-sealed compartments and battery backup

Voice assistant compatibility (Alexa/Google Home) for hands-free operation

Brands ignoring these features risk obsolescence—consumers now expect predictive maintenance alerts и data-driven health insights as standard, not extras.

Supply Chain Stability: The Non-Negotiable Foundation

Manufacturing smart pet tech requires partners who balance innovation with operational rigor. China remains the optimal hub for electronics manufacturing due to mature component supply chains, but quality control and scalability are non-negotiable. Defect rates above 1% trigger costly recalls and reputational damage—especially for IoT products where software glitches can compromise safety.

Critical Supplier Attributes for Smart Pet Tech OEMs

| Attribute | Why It Matters | Supplier Benchmark |

|———–|—————|———————|

| FCC/CE/RoHS Certifications | Ensures regulatory compliance for global markets | Mandatory for U.S./EU sales; RoHS guarantees eco-friendly materials |

| Tuya/Matter IoT Integration | Enables app control & ecosystem compatibility | 90% of top-selling products use Tuya; Matter for future-proofing |

| ISO 9001 Quality Control | Reduces defects and returns | 100% functional testing; <1% defect rate in production batches |

| Scalable Production | Supports seasonal demand spikes | MOQ 500–1,000 units; 30-day ramp-up for 10K+ units |

Brands partnering with ODMs that enforce these standards see 30% lower defect rates и 20% faster time-to-market. In a sector where 60% of buyers cite “reliability” as their top purchase factor (Global Pet Expo 2025), supply chain stability isn’t just operational—it’s your competitive moat.

Designing Winning Products: Key Features & Innovations

Product Innovation & Key Features: Engineering Trust Through Precision

In 2025’s hyper-competitive pet tech market, product quality is no longer optional—it’s the baseline for survival. With 68% of pet owners abandoning a smart pet product after a single malfunction (APPA 2025 State of the Industry Report), every component must be engineered for reliability. Global buyers demand technical excellence that translates to real-world resilience, not just “smart” buzzwords. Here’s how to future-proof your product through material science, intelligent engineering, and seamless connectivity—backed by supply chain rigor.

Material Safety: The Non-Negotiable Foundation

Consumer trust begins with material integrity. BPA-free certifications (FDA/EFSA-compliant) are table stakes, but premium products go further:

Stainless Steel 304 (>18% chromium, 8% nickel) resists corrosion, acid exposure, and bacterial growth—critical for water bowls, feeders, and grooming tools.

Food-Grade ABS/PP must meet ISO 10993 biocompatibility standards for direct pet contact.

Avoid “304-Labeled” Fraud: 37% of budget OEMs misrepresent steel grades (SGS 2024 audit). Demand third-party test reports (e.g., SGS, Intertek) for every batch.

Material Comparison: Standard vs. Premium Sourcing

| Parameter | Budget Tier | Premium Tier | Business Impact |

|———————|———————–|——————————–|————————————–|

| Steel Grade | 201/430 (low nickel) | 304 (certified) | 32% lower corrosion failures; 25% fewer returns |

| Plastic Safety | Uncertified BPA-free | FDA/EFSA-tested | 68% higher brand trust (NPD Group) |

| Supply Chain | Unvetted local mills | TUV-certified suppliers | 92% on-time delivery; 0.8% defect rate |

Why it matters for retention: 74% of pet owners cite “safety concerns” as their top reason for switching brands (Circana 2025). A single recall can destroy a brand—investing in verified materials reduces liability while building emotional loyalty.

Smart Logic: Engineering Fail-Safe Reliability

Smart features must solve real problems—not create new frustrations. Critical technical specs include:

Anti-jamming Motors: Dual-sensor torque detection (e.g., 300g+ obstruction triggers auto-reversal) prevents feeder clogs.

Backup Batteries: 48+ hour runtime during outages (with low-battery alerts via app).

Thermal Overload Protection: Auto-shutdown at 65°C+ to prevent fire risks in electronic devices.

Smart Feature Failure Scenarios vs. Solutions

| Common Failure | Budget Solution | Premium Solution | Retention Impact |

|———————|———————–|——————————–|————————————–|

| Feeder Jam | Single-sensor stop | Dual-sensor + auto-reversal| 41% fewer negative reviews (Amazon data) |

| Power Outage | No backup | Lithium-ion backup + SMS alert | 89% higher customer satisfaction (Pet Age survey) |

| Overheating | None | Thermal cutoff + IoT alert | 92% reduction in safety complaints |

Why it matters for retention: Products with self-diagnostic features see 3.2x higher repeat purchase rates (NIQ 2025). Tuya-certified logic modules ensure seamless integration with Alexa/Google Home—critical for cross-platform compatibility.

Connectivity: Data-Driven Ecosystems

Basic app control is obsolete. Top-tier products leverage IoT ecosystems with:

AI-Powered Analytics: Track feeding habits, activity patterns, and health trends (e.g., “cat ate 20% less today—possible dental issue?”).

Tuya Pro Certification: Mandatory for secure cloud connectivity (AES-128 encryption), OTA updates, and multi-user access.

Privacy-First Design: GDPR/CCPA-compliant data handling—no unauthorized third-party data sharing.

Connectivity Tier Comparison

| Feature | Entry-Level | Premium Tier | Business Outcome |

|———————|———————–|——————————–|————————————–|

| Data Security | Basic encryption | Tuya Pro AES-128 + GDPR compliance | 50% fewer privacy complaints (Forrester) |

| User Engagement | Manual controls only | Predictive alerts + health insights | 67% higher daily app usage (App Annie) |

| Scalability | Single-device control | Multi-pet, multi-room management | 3.1x higher lifetime value (Packaged Facts) |

Why it matters for retention: Pet owners using data-driven apps are 4.5x more likely to purchase complementary products (e.g., supplements, premium food). The US market alone will see $12.4B in smart pet tech sales by 2026—but only for brands that deliver true reliability (Packaged Facts).

The Bottom Line: In 2025, “smart” means zero compromises on safety, engineering, and data integrity. Partner with OEMs who prioritize certified components, rigorous testing protocols, and transparent supply chains—not cost-cutting. This isn’t just about features; it’s about building products that become indispensable to pet parents’ daily lives.

Inside the Factory: Manufacturing & Quality Control

Manufacturing Excellence & Quality Control

As global pet tech demand surges toward $500B by 2030 (per Clarkston Consulting), manufacturing precision is no longer optional—it’s the core differentiator between market leaders and commoditized products. For pet brands targeting premium segments and IoT-enabled devices, cutting corners in OEM/ODM processes directly impacts customer retention, brand reputation, and profitability. Below, we break down critical manufacturing phases where quality gaps manifest most severely, with data-driven comparisons.

Molding & Tooling: Precision for Safety and Longevity

Pet tech products like automatic feeders and water fountains demand micron-level tolerances to prevent bacterial growth, material degradation, and mechanical failure. Generic molds often use low-grade steel (P20 or H13) with tolerances of ±0.1mm, leading to inconsistent parting lines, sink marks, and warpage. These defects cause seal failures in pet food compartments or moisture ingress in electronics—critical risks for food-contact items. Premium OEMs invest in tooling with hardened tool steel (S136 or NAK80), maintaining ±0.02mm tolerances and implementing thermal cycling validation. This ensures consistent wall thickness for food-grade resins (e.g., FDA-compliant PP or ABS), eliminating micro-cracks where pathogens thrive. Crucially, premium molds integrate smart features like embedded RFID tags for traceability and are designed for modular upgrades—enabling future firmware-driven enhancements without retooling.

PCB Assembly (SMT): The Backbone of IoT Reliability

Pet tech’s IoT capabilities (e.g., Tuya-based connectivity, app-controlled feeding schedules) hinge on flawless PCB assembly. Generic manufacturers often use low-cost SMT lines with manual placement and no X-ray inspection, resulting in solder bridging, tombstoning, or weak joints—especially on miniaturized components like Wi-Fi/BLE modules. This causes intermittent connectivity failures or complete device death within months. Premium OEMs deploy automated optical inspection (AOI) + X-ray for BGA components, ensuring 99.98% solder joint integrity. They also implement strict ESD protocols and thermal profiling for lead-free soldering, critical for devices operating in humid environments (e.g., cat fountains). Most importantly, they source Tier-1 chipsets (e.g., Nordic Semiconductor for BLE) with full traceability, avoiding counterfeit components that compromise security—a growing concern for pet data privacy regulations.

Waterproofing & Motor Life Testing: Stress-Testing for Real-World Use

While generic pet fountains may pass basic splash tests, they fail under continuous operation. Premium OEMs apply rigorous, standardized validation protocols:

Waterproofing: IPX7 certification (30-minute submersion at 1m depth) rather than vague “water-resistant” claims. Accelerated aging tests simulate 2+ years of daily use.

Motor Life: Feeders require motors rated for 50,000+ hours (vs. 5,000 in cheap models). Premium testing includes thermal cycling (-20°C to 60°C), vibration stress, and continuous 24/7 operation for 1,000+ hours.

This prevents catastrophic failures like motor burnout or seal degradation—common causes of returns for Amazon sellers.

Premium vs. Generic Manufacturing: The Bottom-Line Difference

| Criteria | Generic Cheap Models | Premium OEM Standards |

|---|---|---|

| Material Quality | Non-food-grade plastics; inconsistent coloring | FDA/REACH-compliant resins; color-matched batches |

| IoT Reliability | No component traceability; frequent disconnections | Full BOM traceability; Tuya-certified modules with <0.1% failure rate |

| Testing Rigor | Basic visual checks; no accelerated aging | IPX7+ waterproofing; 50K+ hour motor life tests; thermal shock validation |

| Supply Chain Stability | Single-source components; reactive ordering | Dual-sourced critical parts; real-time inventory visibility; ISO 9001-certified suppliers |

| Total Cost of Ownership | High returns (15-25%), brand damage | <5% returns; 30%+ higher customer lifetime value |

Strategic Insight: Premium manufacturing adds 10-15% upfront cost but reduces warranty claims by 60-70% and enables premium pricing (20-30% markup). For brands targeting the $40.9B US dog food market (APPA), this isn’t an expense—it’s the only path to sustainable growth in a crowded, quality-conscious landscape.

Global Compliance: FCC, CE, and Material Safety

Compliance, Certification & Logistics: Ensuring Market-Ready Products

For global pet tech brands, regulatory compliance and logistics precision are non-negotiable foundations for market success. With IoT-enabled products (e.g., smart feeders, GPS trackers) dominating 2025 trends, oversight of certifications, packaging, and supply chain timelines directly impacts product quality, brand reputation, and profitability. Below, we break down critical requirements for US/EU markets, Amazon FBA standards, and Shenzhen manufacturing realities.

US & EU Regulatory Requirements

Pet tech products require region-specific certifications to ensure safety, electromagnetic compatibility, and material integrity. In the US, FCC Part 15 certification is mandatory for all wireless devices (e.g., Bluetooth/Wi-Fi-enabled pet cameras), validating electromagnetic emissions. For the EU, CE marking (encompassing EMC and Low Voltage Directive compliance) is compulsory, alongside RoHS restrictions on hazardous substances like lead or mercury. Food-contact components (e.g., automatic feeder bowls) demand FDA 21 CFR 177 (US) or EU Regulation 10/2011 (food-grade plastics) certification. Leveraging pre-certified IoT modules (e.g., Tuya’s certified chipsets) reduces testing time by 50% and minimizes compliance risks, as these modules undergo rigorous pre-testing for FCC/CE standards.

| Certification | US Requirement | EU Requirement | Key Notes |

|---|---|---|---|

| FCC | Mandatory (wireless) | Not applicable | Tuya modules simplify testing; FCC ID required |

| CE Marking | Not required (FCC covers some aspects) | Mandatory (EMC, LVD) | Technical documentation must be retained for 10+ years |

| RoHS | Voluntary but retailer-standard | Mandatory | Limits 6 hazardous substances; critical for PCBs |

| Food Grade | FDA 21 CFR 177 | EU 10/2011 | Essential for food/water-contact materials; third-party lab testing required |

Amazon FBA Packaging Standards

Amazon’s FBA program enforces strict packaging rules to prevent damage during transit. All products must pass a 40-inch drop test (48 inches for items >50 lbs) per ASTM D4169 standards, with cushioning (e.g., molded pulp or bubble wrap) to absorb shocks. Packaging must include scannable FNSKU barcodes, moisture-resistant labels, and tamper-evident seals. For electronics, retail-ready packaging is often required before FBA shipment—meaning the product must be sealed in its final consumer box with clear branding. Non-compliance results in rejected shipments, storage fees, or damaged inventory. Always verify against Amazon’s latest FBA Packaging Guide; minor oversights (e.g., incorrect label placement) can trigger 30+ day delays.

Shenzhen Manufacturing Lead Times & Stability

Shenzhen-based OEMs typically deliver production in 45–60 days, but certification testing (FCC/CE) adds 4–8 weeks—making total lead time 60–90 days for IoT pet tech. Proactively engage certified labs for pre-testing to avoid rework; for example, Tuya-certified modules cut FCC/CE testing from 8 to 3 weeks. Supply chain stability hinges on two factors:

Supplier vetting: Prioritize ISO 9001-certified manufacturers with dual-sourcing for critical components (e.g., sensors, PCBs).

Logistics buffer: Global shipping delays (e.g., port congestion) can add 15–30 days. Opt for air freight for urgent launches (7-day transit vs. 30-day sea), but budget for 300% higher costs. Always allocate 10–15% buffer time for quality inspections (AQL 2.5) and customs clearance to mitigate disruptions.

Strategic Takeaway: Compliance isn’t a checkbox—it’s a competitive advantage. Brands that embed certifications into early R&D (e.g., designing for Tuya modules) and partner with Shenzhen suppliers experienced in US/EU exports will outpace competitors in quality, speed-to-market, and cost efficiency.

Sourcing Strategy: From Prototype to Mass Production

How to Source or Customize Pet Tech Products for 2025

The global pet industry is projected to reach $500 billion by 2030, with smart pet tech driving 15%+ CAGR growth (APPA/Circana). As brands pivot toward IoT-enabled products like GPS trackers, automated feeders, and health monitors, sourcing partners must deliver technical precision, supply chain resilience, and regulatory compliance—not just basic manufacturing. Here’s how to execute a fail-safe OEM process for high-margin pet tech.

Step 1: Request Rigorous Technical Samples

Never skip sample validation. For IoT products, test battery life under real-world conditions (e.g., 30-day continuous use for GPS collars), Wi-Fi/Bluetooth range stability in diverse environments, and app integration reliability with Tuya or proprietary ecosystems. PAWBILT provides pre-certified samples (FCC/CE) with detailed compliance reports and stress-test data. A single sample should include:

Hardware durability tests (e.g., IPX7 waterproofing for outdoor smart feeders)

Software crash tests (10,000+ app interaction simulations)

Thermal performance metrics (e.g., 40°C ambient temperature operation)

Industry Insight: 68% of Amazon sellers reject products after failing sample validation (Packaged Facts). PAWBILT’s in-house IoT lab cuts sample-to-production time by 40% through automated testing protocols.

Step 2: Define Smart Customization with Precision

Beyond basic logo/packaging, pet tech requires hardware-software co-design. Key customization points:

| Customization Aspect | Typical OEM Approach | PAWBILT Advantage |

|---|---|---|

| IoT Integration | Generic Tuya modules, limited firmware support | Full-stack Tuya integration with custom analytics dashboards and OTA update capabilities |

| Material Sourcing | Single-source suppliers for critical components | Dual-sourced semiconductors + regional warehousing for 30% faster lead times |

| Regulatory Compliance | Post-production testing only | Pre-emptive certification (FCC, CE, PSE) with real-time design tweaks |

PAWBILT’s engineers collaborate from Day 1 to embed brand-specific features—like scent-resistant coatings for smart litter boxes or breed-specific nutrition algorithms for feeders—while ensuring ISO 13485 medical-grade quality for health-monitoring devices.

Step 3: Execute a Data-Driven Pilot Run

A pilot run of 500–1,000 units is non-negotiable. PAWBILT uses IoT-enabled production tracking to monitor:

Real-time defect rates via AI-powered visual inspection (e.g., 99.9% accuracy for circuit board flaws)

Supply chain health (e.g., component lead times, raw material traceability)

End-to-end logistics performance (e.g., FCL vs. LCL shipping cost optimization)

This phase validates scalability and identifies bottlenecks before full-scale production. For example, a smart pet camera pilot revealed a 15% failure rate in cold-weather operation—resolved by PAWBILT’s thermal management redesign in 72 hours.

Conclusion: Partnering with PAWBILT eliminates 80% of pet tech sourcing risks. Their end-to-end solution—from Tuya-certified samples to pilot-run analytics—ensures your product launches on time, meets premium quality standards, and capitalizes on 2025’s $40.9B U.S. pet food and tech market surge. Schedule a consultation today to align your product roadmap with market-defining trends.

💰 OEM Profit Margin Calculator

Estimate the gross profit for your private label pet product trends 2025 business.